December 19, 2025

India 101: The Long-Term Investment Case

Twenty-five years ago, India ranked just above Iran and Argentina in terms of economic size. Italy’s GDP was nearly one and a half times larger than India’s1. The Indian economy doubled, then doubled again, and then more than doubled again. Today, India boasts a $4.2 trillion GDP and at a real annual growth rate of 6-7% and a nominal growth rate of 10-11%, it could double again in the next 7 years2. India’s GDP is set to surpass Japan’s in 2025, and India is soon expected to overtake Germany as the world’s 3rd largest economy, behind the United States and China. How did this happen? How long will this growth continue? And what does it mean for investors?

Rising urban middle class and private consumption. India is following a similar development path to that taken earlier by the more economically advanced northern Asian countries, most notably China. Its population is transitioning from rural areas to urban centers, and from traditional agriculture to “modern” industry, not only services but also increasingly manufacturing.

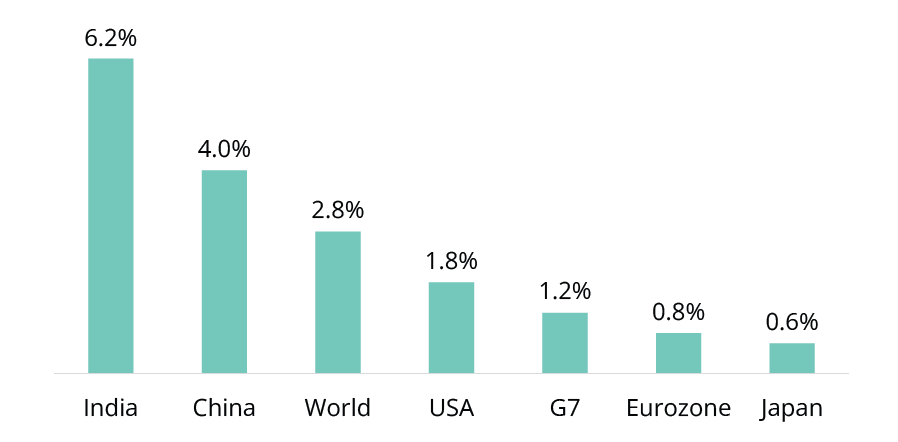

GDP Growth (CY 2025e)

Source: International Monetary Fund, World Economic Outlook Database (April 2025)

Economic productivity is rising, people are earning more and spending more, leading to a significant increase in private consumption and the growth of many industries. At the same time, the development of physical and digital infrastructure is enabling and strengthening overall economic growth. In turn, the country is modernizing rapidly.

From farm to cities, the urban migration trend is far from abating. It should continue for at least a couple of decades because nearly half of the Indian working population is still involved in agriculture, compared with only 22% in China and less than 2% in the United States3. As of 2024, nearly two thirds of Indians still lived in rural areas, compared with 33% in China, or 17% in the United States4.

India’s economic growth story has a long way to go.

1. International Monetary Fund, World Economic Outlook Database (April 2025)

2. International Monetary Fund (June 2025)

Large, young, and growing population. India is particularly well positioned because of the size and growth of its population. Compared with China, which is aging and whose working population has been in decline since 2015, India’s current population of nearly 1.5 billion people is projected to rise to 1.7 billion by the early 2060’s.

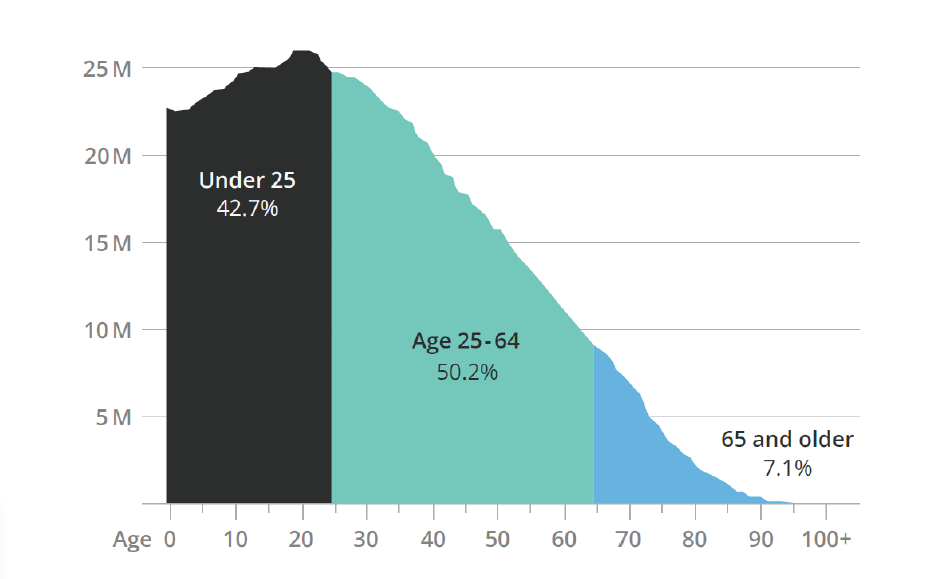

More than 40% of Indians are younger than 25 years old, and people age 25 and under are projected to outnumber those 65 and older until the late 2070's5. A large, critical mass of young people provides economic benefits and represents a significant advantage for a country digitalizing its business infrastructure and encouraging the adoption of new technologies.

Number and Share of People in India, By Age

Source: UN Population Division’s World Population Prospects (2022 Revision); Pew Research Center (February 2023)

The population pyramid for India predicts a significant increase in the labor force each year for the next few decades. The growth in the working population is expected to result in a significant increase in consumer demand, higher tax revenues for the government and a better fiscal position. It will increase the country’s aggregate savings, which will expand the availability of domestic financing for growth.

Demographic dividend. When the working population has too many children to feed, as in Africa, or too many old people to care for, as in Western Europe or Japan, the economy can suffer. The good news for India is that its growing working population faces relatively low pressure from dependents. This should remain true for many years: in 2025, the ratio of total dependent population to total working age population is expected to be at its lowest point in history and will remain at this low level until at least 20406.

This bodes well for India. In the past, this same shift in population structure initially drove higher economic growth in other countries such as Japan (starting in 1964), Korea (starting in 1987) and China (starting in 1994).

Domestically-driven economy. Unlike other emerging economies that rely on exports to sustain growth, India is fundamentally driven by internal factors. As the end of 2024, private consumption accounted for nearly 65% of India's nominal GDP, a two-decade high and among the largest share globally for a major economy. India’s total trade, the sum of its imports and exports, is only 45%, relatively low compared with other emerging economies.

In an era of tariff threats and de-globalization fears, it is reassuring to know that India’s exports to the United States only represent approximately 2% of its GDP7.

Economic success is not destiny. Countries must work at it. Moving people from rural areas to cities does not necessarily make them more productive, and a demographic dividend does not guarantee economic growth. As we discussed in our paper “India 2.0: The Next Phase of Growth”, India has recently embraced reforms and initiatives that will make its economic transition successful. It is educating its people, embracing new technologies, and encouraging the digitalization of many industries; it is implementing new regulations, streamlining and reducing taxes, and formalizing various sectors of its economy; it is broadening and deepening its financial system.

In doing so, India has started to mobilize local capital while making itself more attractive to global investors. With the rise in manufacturing and the acceleration of the construction sector, it is now improving its ability to absorb the migration from farms to cities and to employ its young people at the levels needed to match the growth of its working population.

3. Indian Economic Survey 2024-2025; World Bank Open Data; Trading Economics

4. World Bank Open Data; Trading Economics; Statista.com

5 Pew Research Center (February 2023)

6 Trading Economics

7 CEIC Data; Trading Economics

A Different Kind of Emerging Market

For emerging market investors, India stands out.

Compared with China, India offers a stable political environment and a reassuringly familiar democratic political system. It also boasts a sophisticated financial system that is modeled on, and functions like, those in the West. Not only is India the oldest democracy in Asia, it also has the oldest stock market, the Bombay Stock Exchange, which has been operating since 1875 and is not subject to the kind of government intervention that can affect investors in other emerging markets like China. Market considerations rather than political guidance drive the allocation of credit from private banks to the economy.

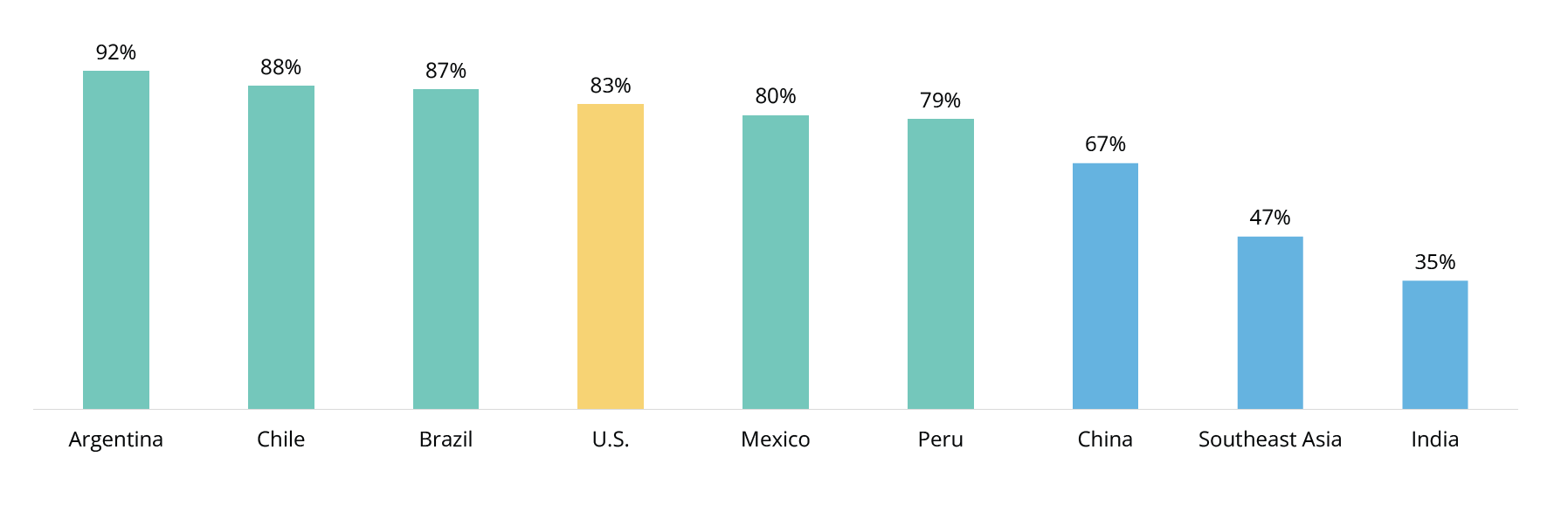

With respect to the rest of developing Asia, India is potentially set to enjoy stronger economic growth for many more years than its more developed neighbors. It is still in the early stages of its development, and its social and economic transformation has a longer way to run. While India is modernizing rapidly, its level of urbanization, around 35%, remains lower than in Southeast Asia (around 47%), and it will take a couple of decades before it reaches the level of China (around 67%)8. India’s $2,700 GDP per capita reflects the country’s early stage of development, compared with $4,600 in Vietnam, $5,000 in Indonesia, $7,500 in Thailand, or $13,300 in China9.

For investors with a long-term horizon, this means that India has the potential to enjoy a longer period of high economic growth.

India stands out compared with developing countries outside Asia. While Investors tend to group all developing countries in a single “Emerging Markets” asset class, their socio-economic drivers of growth are fundamentally different. In South America, for example, the urbanization trend that drove China’s growth during the past two decades (and that will drive India and Southeast Asia forward in the coming years) is not going to be a meaningful contributor to growth. How do we know this? Simple: Brazil, Argentina, Mexico, Chile, Peru, and Columbia are already as urbanized or more urbanized than the United States!

In places like Brazil, the urban middle class rose, but sadly, did not rise enough. These countries are stuck in the so-called “middle-income trap,” part of a group of economies that went through urbanization and yet, for lack of savings, investments and successful policies, did not reach their full potential. Their economic fortunes follow the ups and downs of the political and commodity cycles. They are trading markets rather than long-term investment markets. As the Brazilians like to say of their own country, “Brazil is the country of the future and always will be.”

Urbanization Levels (2024)

8. World Bank; Trading Economics; Earth Observatory of Singapore

9. International Monetary Fund, World Economic Outlook Database (April 2025)

India also stands out compared with developed markets. The weight of India in the MSCI ACWI Index is only 1.69%, roughly in line with that of Australia, or the combination of Italy and Spain. Yet, its economy and stock market capitalization are significantly larger.

Foreign investors have not yet started to allocate meaningfully to India, but we believe that eventually, they will. Savvy investors should consider getting in early.

As it emerges from the shadow of China, India offers the opportunity to invest in a different kind of emerging market. As a one-country investment destination, it represents an attractive alternative to a broad emerging market portfolio.

Translating Economic Growth into Investment Returns

This is all fine, skeptics will say, but as many analyses have shown, economic growth does not always translate into stock market returns. True, but such analyses are often flawed in one way or another. It may be the measuring period, as these are volatile markets and picking one set of dates rather than another changes the conclusions drastically. It may be how far one goes into the past as the country, its economy, and stock market may now be entirely different from what they were only recently (recall that twenty-five years ago, India only had a $470 billion GDP). It may be the benchmark used, as the composition of the index is rarely representative of emerging market economies.

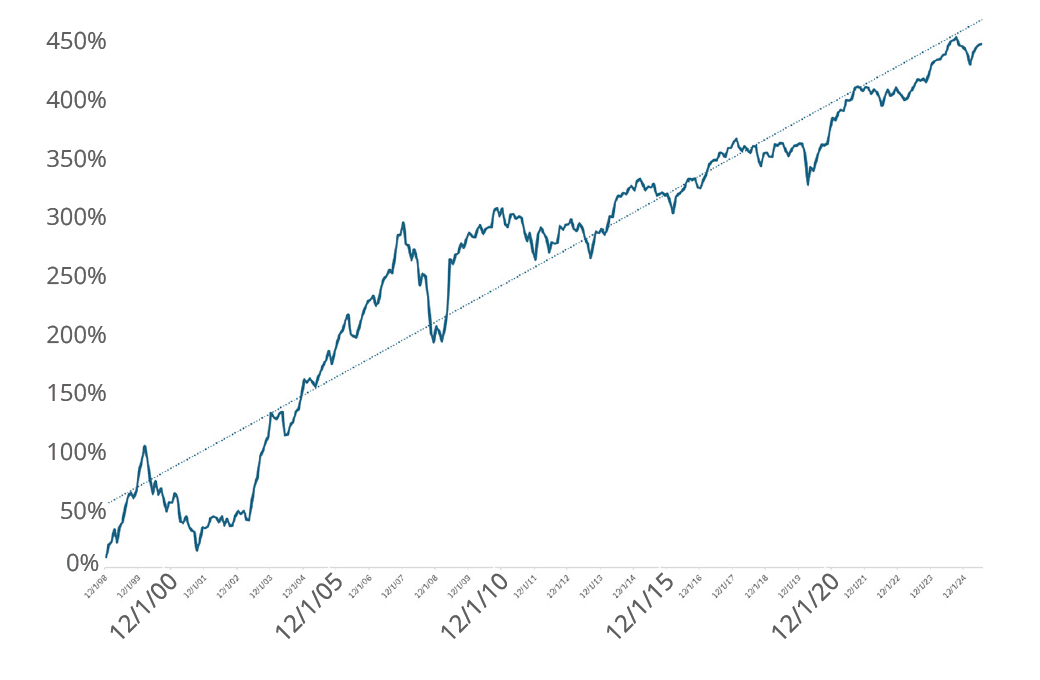

In any case, in India, the correlation between GDP growth, corporate earnings, and stock market returns has been very strong, and over the past two and a half decades, the Nifty 500 stock index has appreciated at a 13.6% CAGR in U.S. dollars10.

What anyone traveling to India can observe is that the rise of household incomes is fueling the growth of many companies that provide goods and services to the rising urban middle class. In particular, the companies targeting the right tail of the income curve can generate phenomenal growth.

Translating Economic Growth into Investment Returns

As our friends at Gavekal Research have astutely observed, when it comes to the purchase of certain goods and services, there are key income “thresholds’’. For example, households earning less than $1,000 a year rarely own a television set; yet, most of those with an annual income above $1,000 buy one. For smartphones, the level of annual income for mass adoption seems to be around $2,500; for automobiles, $10,000; for financial products like insurance, brokerage accounts and mutual funds, $30,00011.

10. Bloomberg

11. “The revenge of the Ottoman Empire”, Gavekal Research (December 2023)

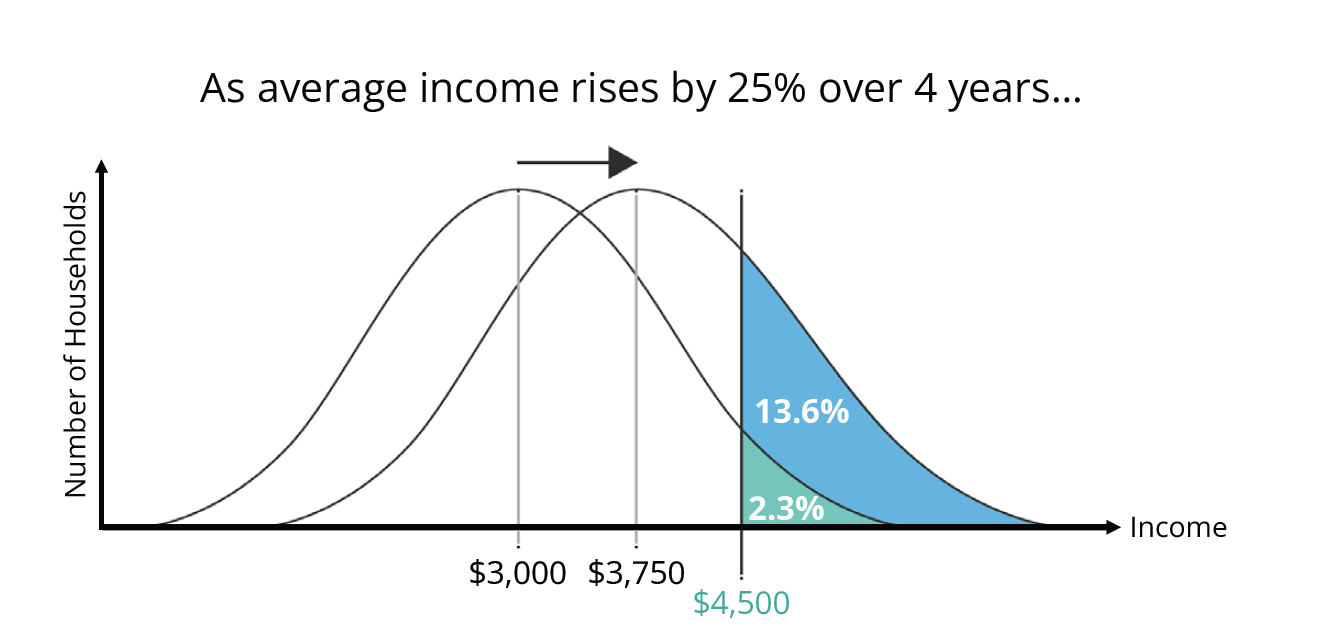

Now, assume that India has a population with a normal “bell curve” distribution of incomes12. Also assume that the median annual household income grows by about 6% per year, increasing from $3,000 to $3,750 after four years13. While income goes up by 25%, the number of households earning more than say, $4,500, does not increase by 25%. Because the entire bell curve shifts to the right, and the number of households earning more than a certain amount is determined by the area under the bell curve, the share of households earning more than $4,500 goes from 2.3% to 15.9%, an increase of almost seven times!14

The Acceleration Phenomenon15

...the share of the population with incomes above $4,500 jumps nearly 7 times, from 2.3% to 15.9%.

This gives rise to what is known as the “acceleration phenomenon.” As GDP and incomes rise at a steady pace, the demand for products at particular price points on the right tail of the income distribution can grow at many times the overall rate of economic and income growth. This is what happened in China in the 2000s: at the start of the decade, automakers were selling 2 million cars a year, and 10 years later, annual sales had hit 18 million vehicles!16

Interestingly, for those companies selling products or services on the left tail of the income distribution, the addressable market grows more slowly than the overall rate of income growth. An investment strategy built around “eat, drink, wash” products was well adapted to India twenty years ago, when the population was much poorer; today, not so much. This is one of the (many) reasons why emerging market index funds are rarely good investment vehicles.

Investors can be richly rewarded by understanding which segments of the market are set to grow disproportionately fast as incomes rise and the structure of demand shifts. For stock pickers who gauge this acceleration phenomenon correctly, India is likely to offer a series of attractive investment opportunities in the decades ahead.

10 Bloomberg

11 “The revenge of the Ottoman Empire”, Gavekal Research (December 2023)

12 The income distribution in India is not a normal bell curve but is skewed to the right (a long tail of very high earners and a large mass of people with much lower incomes). The empirical pattern aligns most closely with a fat-tailed or Pareto-type distribution at the top, and a log-normal or similar distribution for the majority of the population. This analysis uses a normal bell curve for simplification purposes, the conclusions being broadly similar.

13 The median income rose at a CAGR of 5.9% between Fiscal Year 2017–18 and Fiscal Year 2023–24. India does not track the median annual household income; the mean is 360,000 rupees and the median should be lower. Source: Periodic Labour Force Survey (PLFS); “Income Inequality Patterns Across India”, Institute for Competitiveness (June 2025)

14 “India’s Acceleration Phenomenon”, Gavekal Research (January 2019)

15 The “acceleration phenomenon” and its impact on the growth of consumption in emerging markets such as India and China has been studied extensively by Gavekal Research. This analysis and chart representation are inspired by their research papers.

16 “The revenge of the Ottoman Empire”, Gavekal Research (December 2023)

Disclosures:

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Any index or benchmark shown or discussed is for comparative purposes to establish current market conditions. Index returns are unmanaged and do not reflect the deduction of any fees or expenses and assumes the reinvestment of dividends and other income. You cannot invest directly in an index.

This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Wealth, LLC (“Focus Partners”), an SEC registered investment adviser with offices throughout the country. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of Focus Partners or its representatives. Prior to January 2025, Focus Partners was named The Colony Group, LLC. Focus Partners has been part of the Focus Financial Partners partnership since 2011.

©2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-4618445

About the Author

Frank Brochin

Chief Investment Officer, Family Office