May 16, 2025

Innovation is the New Moat

The trajectory of innovation today provides a boundless basis for a new generation of discoveries that can support higher productivity, accelerating returns on capital, compelling environmental solutions and greater well-being for all.

Transformative innovation ecosystems will likely define a new era enabled by “the convergence of exponential technologies.”1 The critical tools of our digital age, computational power and data, are now widely accessible, releasing innovation from the confines of large companies, labs and universities and empowering the creative capabilities of entrepreneurs across the globe. Moats that historically protected businesses now face the possible threat of disruption.

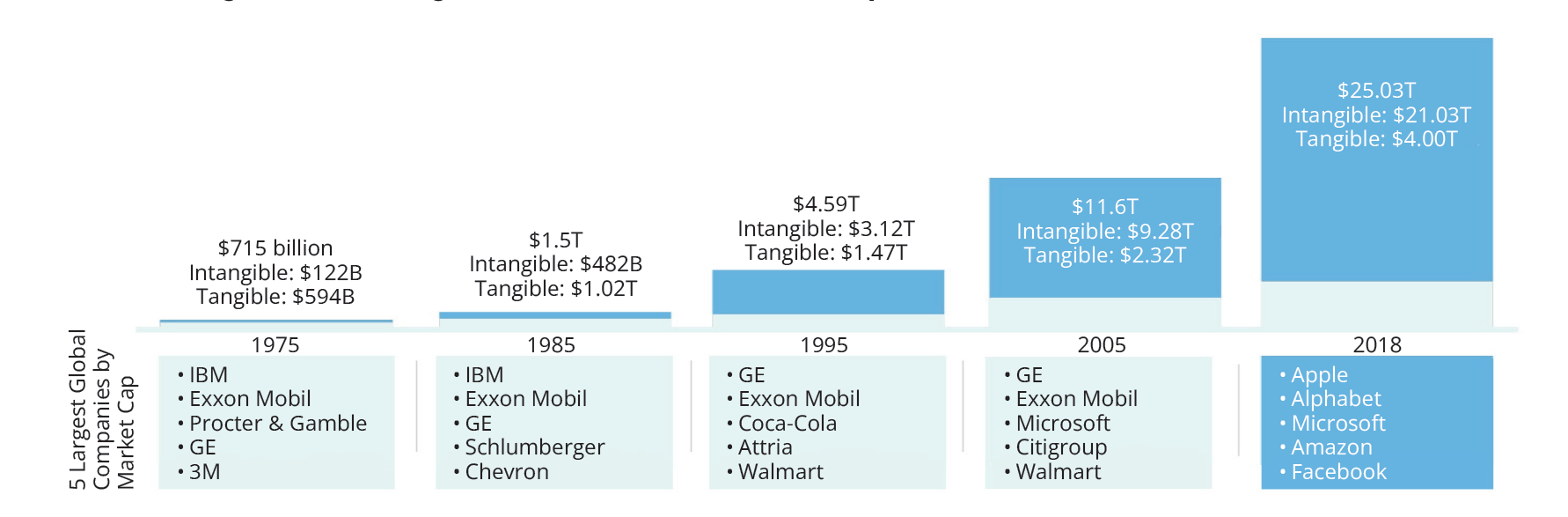

In our opinion, the investment implications of this era of innovation cannot be overstated. The potential to capture outsized returns and avoid devastating losses seems to mandate that we and our underlying managers continually work to understand emerging innovations and technological ecosystems. These forces are transforming businesses, industries, societies, and driving irreversible shifts in market share. A number of insurgent startups are launching with de minimus capital yet with the scaled computational capabilities of established incumbents. Faster, smarter, lighter, cleaner, cheaper, more efficient systems will probably achieve superior outcomes. New value propositions supported by asset light models, recurring revenue platforms, lower cost structures, and the redefining of customer engagement (Chart 1) have evolved in ways that would not have been possible 5 and 10 years ago. Opportunities in this environment can achieve high and potentially uninterrupted multi-year growth rates with catalysts that are independent from broad market influences/narratives. It must be noted, however, that competition is accelerating along with innovation. New entrants are at risk of being insufficiently innovative to capture market share or becoming obsolete before they can get to market. Our firm is building exposure with managers we believe are exceptional investors at the forefront of their respective fields.

We believe that traditional investment frameworks must be recalibrated to capture the impact of innovation as an increasingly dominant source of value. “Today, value investing’s core tenet of a margin of safety is established by a technologically and competitively privileged business position rather than metrics such as statistical cheapness, tangible asset values or financial engineering.” The challenge of this age of innovation requires a reasoned assessment of what the future will provide and a cautious reassessment of the accepted models of the past. What is clear is that old assumptions around investing are up against a tidal wave of change.

In this paper, Innovation is the New Moat, we aim to provide a greater appreciation of the scope and magnitude of the change we are witnessing. We will discuss the critical advancements that have catalyzed an epochal inflection point for innovation. We will then explore five broad areas of innovation and evolving technological ecosystems highlighting cutting edge developments with the potential to fundamentally reshape businesses, industries, and our lives. We will conclude with some thoughts on how we are approaching these changes, opportunities and challenges from an investment perspective.

Chart 1: Tangible vs. Intangilbe Assets for S&P 500 Companies

PART 1: Critical advancements driving innovation

Setting the Stage: This Time is Different. “This time is different” are dangerous words but are increasingly appropriate to categorize the technological revolution that is omnipresent in our daily lives. Over the last 20 years, we have created a digital world that we depend on to accomplish everything from building social networks, to working from home, telemedicine and 24/7 shopping. This paradigm shift has likely been enabled by a radical democratization of access to the tools needed to create transformational technologies. The stage is set for change on the scale of the nineteenth century’s electrification of industries and households which unleashed previously unattainable productive capabilities. In today’s case, exponential increases in computing power, commensurate cost declines and the resulting ascendancy of software have empowered millions of individuals and entrepreneurs. These advancements have fundamentally altered the scale, scope and speed of innovation.

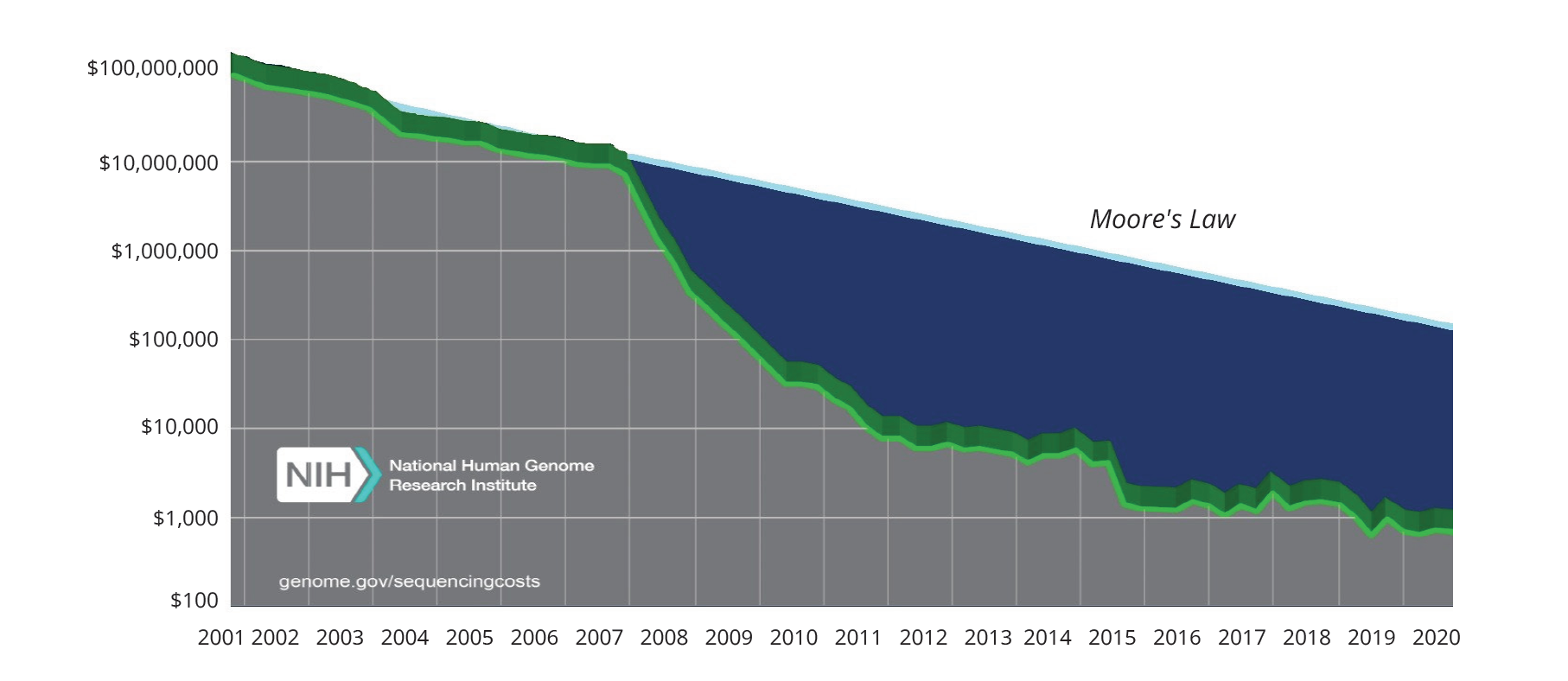

To illustrate the magnitude of these developments, consider the Human Genome Project (HGP). The HGP was an international research initiative to map an entire genome launched in 1990. It took 13 years and had a total cost of $5B in inflation adjusted dollars. Today, an accurate gene sequence can be completed in a few hours for less than $1,000 (Chart 2). A 30 millionfold decline in the cost of DNA sequencing2 in less than two decades has led to a corresponding explosion in data and ultimately the creation of an innovation ecosystem that was previously not economically or practically possible. Millions of individuals have had their genes sequenced and analyzed. This has generated medical insights from a volume of data that was incomprehensible when the HGP began. Startup biopharmaceutical firms, whose financial resources are miniscule relative to the HGP’s project cost and established industry peers, now have access to exponentially more robust datasets and analytical power. The impact is game changing. We are witnessing transformative growth in molecular medicine. Precision medicines are now available to address previously incurable illnesses. In 2020, it took less than a week to develop multiple mRNA vaccines for COVID-19, a timeframe once considered inconceivable. Legacy moats built around lower cost of capital, installed equipment/production infrastructure and a privileged ability to attract top talent are being eroded. We believe that innovation is the new moat, and it is happening across sectors and geographies.

The ability to analyze staggering amounts of data with incredible speed and at plummeting costs are interrelated and self-reinforcing. A computer and an internet connection can instantaneously provide millions of individuals/companies access to more quantitative power and data than the largest companies in the world could afford historically. The continuous digitalization of our lives (interactions, ecommerce, etc.) and our businesses is creating tremendous amounts of data. By leveraging cloud infrastructure, companies no longer need to purchase and maintain stacks of servers (once a competitive advantage) and in many cases would be disadvantaged by doing so. Vast data sets enable Artificial Intelligence (AI) and Machine Learning (ML) technologies (discussed in Part 2) to interpret, learn and formulate predictive relationships. One endgame of AI and ML technologies is the coordinated automation of tasks, which reduces costs, increases output and product reliability.

Chart 2: Cost per Human Genome

Source: https://www.genome.gov/about-genomics/fact-sheets/Sequencing-Human-Genome-cost

PART 2: The tools of innovation ecosystems will likely come from these five categories

- Artificial Intelligence | Smart data analytics, machine learning, robotics, AR, VR, AIaaS

- Genomics and Life Sciences | A golden age for medicine and well being

- Next Generation Internet 3.0, Blockchain, and 5G Communication | Enabling digital asset ecosystems and faster more secure communication

- Energy Production and Storage | Transformative power generation

- Materials Science | All-important foundational platform for the new era of innovation

1. ARTIFICIAL INTELLIGENCE

The recent advancements in AI have been dramatic, however AI is still in the nascent stages of development. We will reference examples that show its possibilities and potential, but the emergence of super intelligent machines, the singularity, is still in the future. Human deduction and reasoning are extremely complex requiring many more levels of processing than are possible in our current binary/neural methodology of digital computing. Next generation neuromorphic computing will attempt to decouple from current computer design and tap into the human ability to process, learn, and memorize all at the same place and time. Today, AI provides powerful, interpretive data analytics with the potential to significantly enhance productivity including automating increasingly complex tasks. Recent innovations in AI such as chatbots, “smart” neural networks, deep learning protocols and natural language processing may lead to another surge in productivity, creativity and new areas of exponential growth. The development of AI as a Service (AIaaS) will potentially enable humans to effectively partner with AI. This can be the era of man “and” machine rather than man “versus” machine.

Robotics and machine learning. The breakthrough of IBM’s Deep Blue versus Gary Kasparov in 1996 was based on massive, structured data analytics and raw processing power, an impressive feat at the time. A monumental leap forward came in March 2016. Google’s Deep Mind program AlphaGo beat the 18-time world champion, grand master in the board game Go. Go is the most complex board game with 2.1x10170 number of potential combinations. The machine learning program relied on a series of neural networks to identify predictive relationships across vast data sets to learn how to play the game. Grandmasters commented that AlphaGo’s moves were creative, brilliant and included moves a human would not have considered. AlphaGo signaled how expansive the potential applications/impact of machine learning can become.

Autonomous driving is an example of a technological ecosystem that combines machine learning, advanced robotics, edge computing and sensor technology. All-seeing 3D object detection is managed by convolutional (visual) neural networks which capture thousands of points of data from arrays of sensors and cameras. One approach uses LiDAR, a system based on pulsed lasers which many auto companies are testing. Tesla is taking a different approach and is believed to have 4th generation chips driving autonomous vehicles. There will be a winner(s) in time. A challenge for our investment managers is how to assess the value of companies when the winner is often a “take all” outcome.

Augmented and Virtual Reality will provide new ways to experience the world and usher in an era of real time computer and human interface. AR, VR, and the Spatial Web (integrates the physical world with digital content) combined with 5G networks will likely change our everyday lives. The COVID era has seen AR support learning outside the classroom and enabled virtual on-site manufacturing. The military has utilized AR in next generation fighter planes and battlefield ops with extraordinary success. The possibilities for new applications are nearly limitless, ranging from analyzing 3D molecular structures, to retail at home, virtual real estate sales and advanced product design.

…[T]he world around us is about to light up with layer upon layer of rich, fun, meaningful, engaging, and dynamic data. Data you can see and interact with. This magical future ahead is called the Spatial Web and will transform every aspect of our lives, from retail and advertising, to work and education, to entertainment and social interaction.4

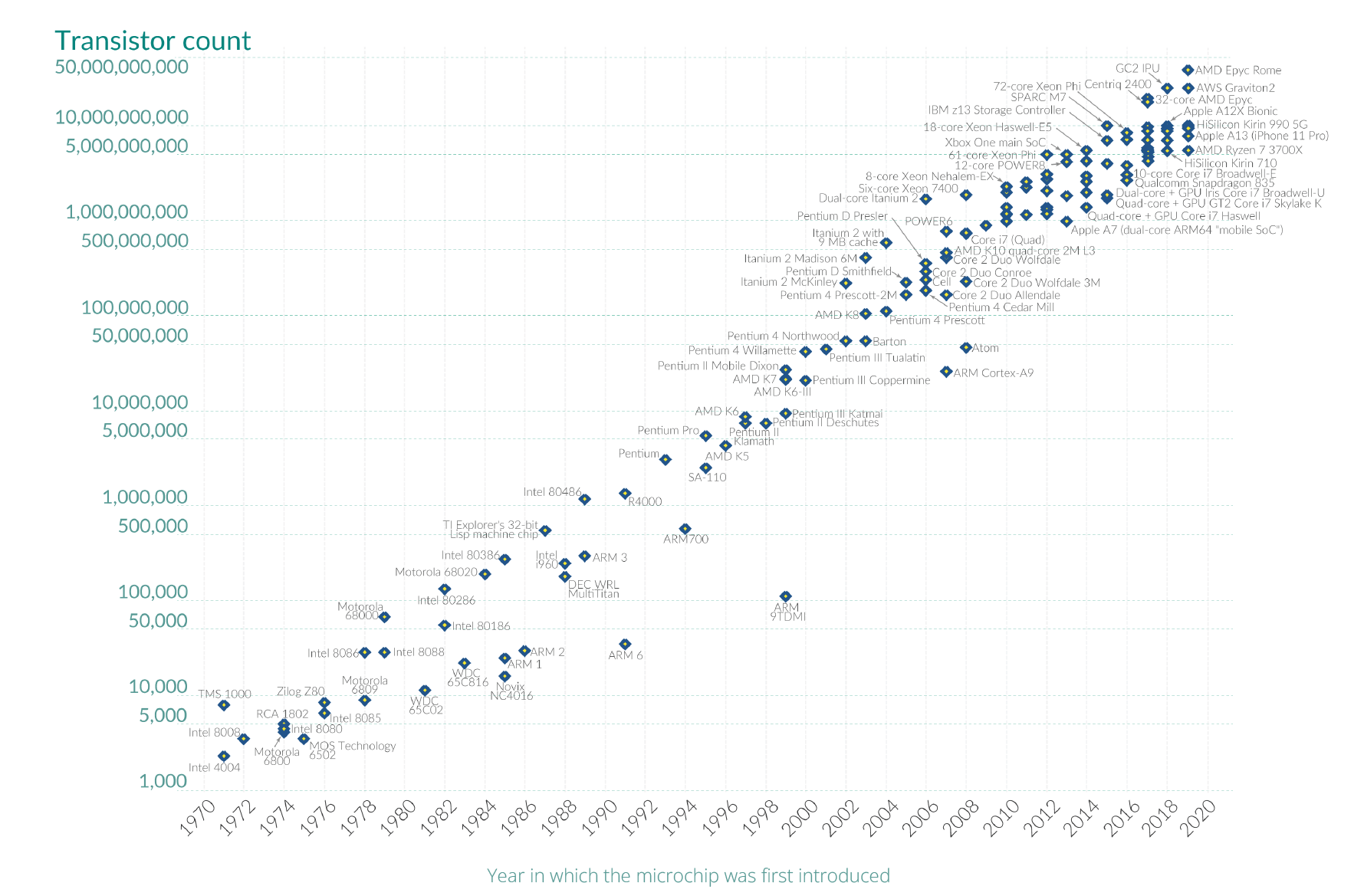

Quantum Computing. Since the invention of the Intel 4004 processor in 1971, there has been a 330+ billionfold improvement in processing power, current ICs are 80k times faster and 4.2mm times cheaper.5 Quantum computing and the quantum internet are closer to reality than many realize. Quantum bits or Qubits have “clock speeds” measured in a trillion logic operations per second (teraflops) while today’s processors work in gigahertz or a few billion logic operations per second. The race for Quantum Supremacy reached a milestone in October 2019, when Google announced their Sycamore processor performed a 54-qubit calculation, which is beyond the reach of the most powerful supercomputers today. It is expected that a single 100-qubit processor would have more power than all supercomputers combined!

3D printing technology has made major strides enabling cost effective, seamless on demand digital printing/manufacturing. 3D printing will be able to thrive in a period of advanced alloys, synthetic metamaterials and new structural designs. The company Relativity Space is presently using 3D printing to create rockets to launch satellites. Its own description speaks to many elements of what this paper is addressing:

As a vertically integrated technology platform, Relativity is at the forefront of an inevitable shift toward software-defined manufacturing. By fusing 3D printing, artificial intelligence, and autonomous robotics, we are pioneering the factory of the future. Leading an unrivaled team to solve problems never solved before… we are revolutionizing how rockets are built and flown.6

3D printed structures will likely lead to lighter, stronger, and safer cars and airplanes, among other things. In addition, we believe that there will be numerous opportunities for on demand custom medical devices.

Chart 3: Moore's Law – The numer of transistors on microchips doubles every two years

Moore's law describes the empirical regularity that the number of transistors on integrated circuits doubles approximately every two years. This advancement is important for other aspects of technological progress in computing - such as processing speed or the price of computers.

Source: https://ourworldindata.org/moores-law Data source: https://en.wikipedia.org/wiki/Transistor_count OurWorldinDate.org - Research and data to make progress against the world's largets problems. Licensed under CC-BY by the authors Hannah Ritchie and Max Roser.

2. GENOMICS AND LIFE SCIENCES

A Golden Age of biotechnology, life sciences and wellness is being enabled by seismic advances in molecular science combined with enhanced computational infrastructure. Next generation bioengineering and diagnostics including gene sequencing, gene editing and regenerative medicine are all providing the bases for exponential improvements. As a timely example, the COVID challenge has produced a remarkable transformation in platform technologies that use messenger RNA (mRNA) as a tool to provide human cells with a set of instructions to create the body’s defense to fight and/or prevent disease. Using a digital copy of the virus’ genome (not a biological sample), the biotechnology firms Moderna and Pfizer/BioNTech developed their vaccines in less than a week. Discovering the COVID vaccine proved to be a watershed moment in the understanding and application of mRNA.

A challenge investors and biotech innovators face is the intense competition that emerging capabilities enable. Today, disease “targets” are being worked on by many companies using approaches that range from traditional small molecules and antibodies, to next generation molecules, to multiple different uses of RNA, to gene therapies that enable broader expression or change the construct of a protein. We believe that only investment managers that apply thoughtful, specific expertise will be able to consistently discern the winners and losers.

Proteomics – a breakthrough more important than genomics? Perhaps an even more important advancement in proteomics occurred in 2020, which may have been under the radar. This generational breakthrough may change how drug discovery works. In November, Google’s AlphaFold was able to determine a protein’s 3-dimensional structure from amino acid sequences known as protein folding. AlphaFold is a multi-layered AI neural network and this discovery won the CASP (Critical Assessment of Protein Structure) competition established 50 years ago. Identifying the specific structure of proteins that cause disease will enable rapid drug discovery with vastly improved outcomes. It can also be used to solve environmental challenges in food production and recycling among other things. There is considerable work to be done to confirm whether AlphaFold can fully explain key aspects of protein folding, but this is an unquestionably important development. Arthur D. Levinson, Ph.D., Founder & CEO Calico, Former Chairman and CEO, Genentech, has noted:

AlphaFold is a once in a generation advance, predicting protein structures with incredible speed and precision. This leap forward demonstrates how computational methods are poised to transform research in biology and hold much promise for accelerating the drug discovery process.

3. NEXT GENERATION INTERNET 3.0, BLOCKCHAIN AND 5G COMMUNICATION

5G is an enabling technology and will be the primary telecommunications platform supporting extremely rapid gigabit speeds, latency free communication, enhanced cyber security and the next generation of applications and services. 5G is the conduit that enables other innovations to pervade and enhance our lives and the world around us. In addition to high speed and low latency, 5G is a platform for mobile network virtualization and edge computing, bringing the power of cloud computing to the network edge. For the next generation of mixed reality devices and applications, the 5G infrastructure not only provides 100X throughput improvement but also massive, localized computing power to allow services that were otherwise impossible in real time. Cloud Computing has created on-demand computer system resources and data storage over the internet. However, many new applications like autonomous vehicles may require Edge Computing combined with sensor matrices that provide intelligence and processing power at the source.

Blockchain’s distributed ledger technology will advance the next era of accounting, supply chain management, tracking and we believe it is the architecture for next generation financial solutions. Blockchains enable the creation of unique, verifiable digital assets through the use of cryptography. Prior to Blockchain, anything digital, an image, song, program, etc., could be duplicated using its source code. This advancement allows for the direct transfer of value through the internet as easily as information is shared, a transformational development. The rightful owners of assets are verified by a decentralized group of users and all participants can access the entire ledger to confirm transactions. Blockchain provides the infrastructure for digital asset ecosystems that support instantaneous, secure money and asset transfers.

A noteworthy example of Blockchain’s use is the recent sale of the artist Beeple’s digital artwork for $69.3M. This piece was sold as a “nonfungible token,” a unique digital asset (an image in this case) whose authenticity and ownership is verified on a digital ledger or Blockchain. The purchase and transfer of the 38,382 Ether cryptocurrency ($69.3M equivalent) was settled instantly, securely, without fiat currency and without a financial institution.

Blockchain will be able to support and enhance the architecture for the Internet 3.0, which can usher in the decentralization of finance (DeFi), provide interoperability among platforms and change the economics of distribution systems. An example of DeFi is Compound, a digital platform that directly connects lenders and borrowers, replicating this most basic financial service outside of the traditional financial system and with no use of incumbent financial firms. By eliminating the cost of all middlemen, Compound’s interest and borrowing rates are highly competitive. Moreover, all decisions are driven by rules and code removing human judgement and bias and thereby broadening user access through anonymity. Compound currently has over $13B of assets earning interest and over 300,000 users.

4. ENERGY PRODUCTION AND STORAGE

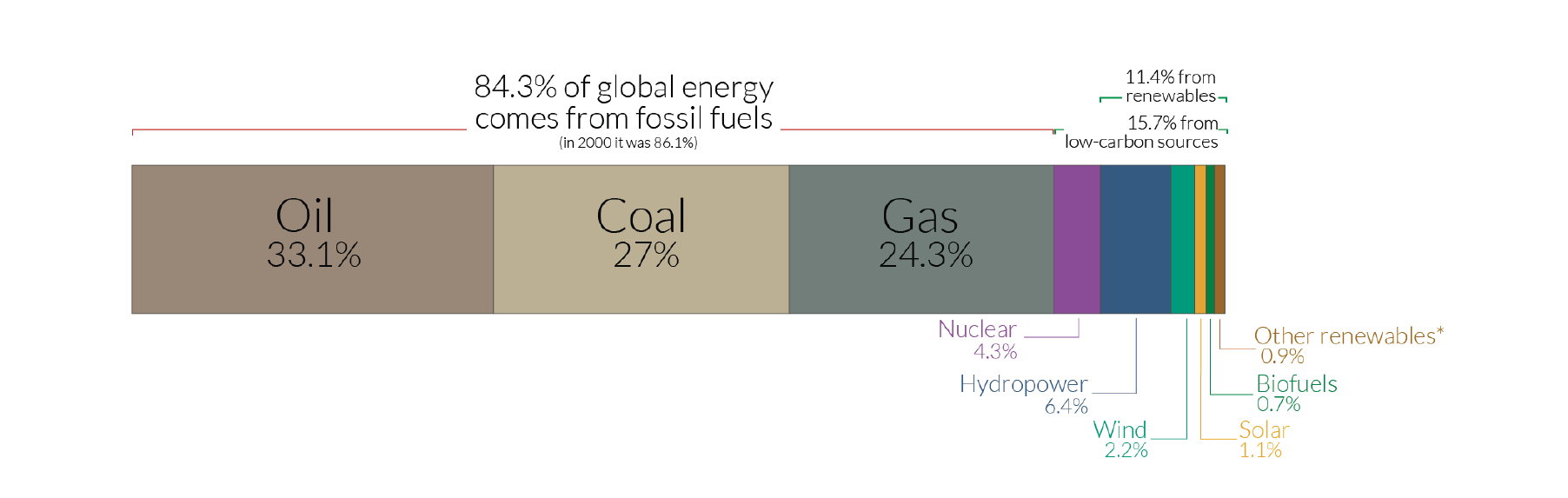

Fracking came of age in the 2000’s and solved the “peak oil” dilemma by changing the focus from the supply side, diminishing supply, to the demand side, we have too much. In our opinion, the future growth of energy sources and solutions will be driven by decarbonization and the many challenges that presents. While many people would like an immediate solution for a decarbonized economy, as Chart 4 shows the world’s reliance on oil and natural gas will likely take years to replace.

We believe that the sources of the next generation of energy production will be ever dependent on each other, due to the intermittency of output. Traditional utilities are working toward a combination of wind, hydro, solar, green hydrogen, geothermal and advanced grid scale storage. As many of these new energy sources are developed, the growth of Virtual Power Plants (cloud based virtual power plants) can provide a local distributed grid that may be more secure, stable and efficient.

Nuclear Power is controversial but is an immensely capable and clean power source. Recent developments in Advanced Small Modular Reactors (ASMR) provide clean, safe and affordable energy. There are currently over 50 ASMR plants under construction (mostly in emerging market) and 300 under consideration. The next generation of fusion power plants will be an optimal solution, in our opinion, but will likely be at least 10+ years before power will be generated. They can produce clean energy and provide consistent, unlimited power generation. The next experimental thermonuclear fusion reactor, ITER,7 is under construction in Southern France and is a joint effort of 35 countries. If successfully completed in 2025, it has the potential to generate more thermal output than it requires to operate. If such a result can be achieved, the next development will be a full-scale electricity producing fusion power plants and a new age in power generation.

Chart 4: Global primary energy consumption by source

The breakdown of primary energy is shown based on the 'substitution' method which takes account of inefficiencies in energy production from fossil fuels. This is based on global energy for 2019.

* 'Other renewables' includes geothermal, biomass, wave and tidal. It does not include traditional biomass which can be a key energy source in lower income settings. Source: Our World in Data based on BP Statistical Review of World Energy (2020). - https://ourworldindata.org/energy-mix OurWorldinDate.org - Research and data to make progress against the world's largets problems. Licensed under CC-BY by the author Hannah Ritchie.

A novel and more innovative approach to advanced nuclear power generation is TerraPower, founded by Bill Gates. TerraPower is using supercomputers to analyze digital simulations of reactor designs. Bill Gates summarizes as follows:

We think we’ve created a model that solves all the key problems using a design called a traveling wave reactor. TerraPower’s reactor could run on many different types of fuel, including the waste from other nuclear facilities. The reactor would produce far less waste than today’s plants, would be fully automated – eliminating the possibility of human error - and could be built underground, protecting it from attack. Finally, the design would be inherently safe .... [a]ccidents would literally be prevented by the laws of physics.8

We believe that our current energy grid will require substantial capital to achieve the environmental goals and power needs our future systems will likely require. While we expect many successful outcomes, each will likely require innovation, technological integration and advances in material science. If the capabilities of ITER or TerraPower’s reactors are realized, it is likely that they will threaten billions of dollars invested in alternative energy. In the meantime, old world technologies will more than carry us through, until next generation technology is available.

5. MATERIALS SCIENCE

Materials Science is often overlooked when one thinks about innovation, but nearly all innovations require the advanced combination of elements to produce new alloys, bioplastics, efficient energy storage, wearable technology, indestructible fabrics, etc.

Graphene is a carbon-based allotrope that is 100 times stronger than steel yet lighter, more flexible and transparent, with applications that can benefit all industries. Graphene can also be a conductor of electricity and its nano-scale sizing could produce the smallest microchips ever developed and take us far beyond the principles of Moore’s law. Recent bioplastic innovations based on PHA (polyhydroxyalkanoate) promise all the benefits of plastics and complete biodegradability in any environment. This may be the ultimate clean solution and is in production today with game changing capabilities.

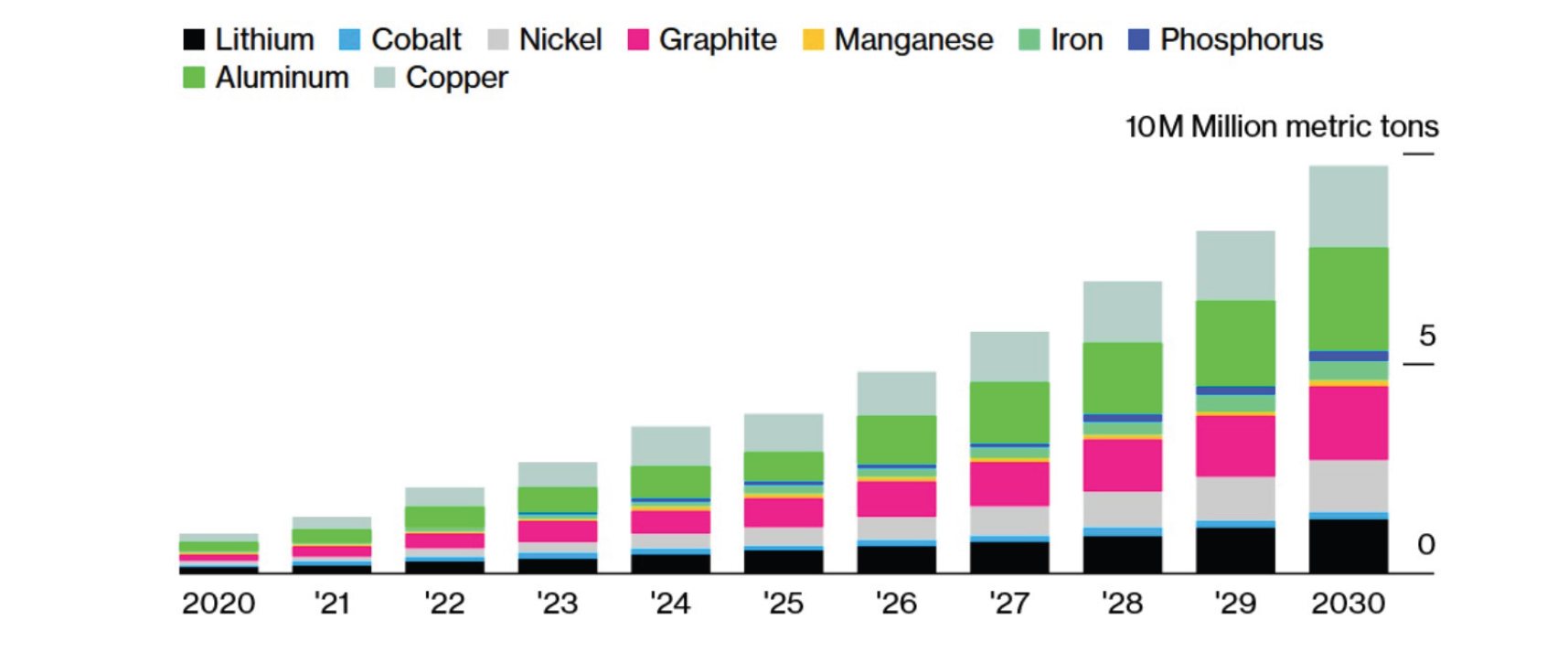

The innovation economy will probably increase demand for a new set of minerals including lithium, graphite, zinc, manganese, molybdenum, phosphorus, copper, silver rhodium, cobalt, nickel, vanadium and rare earth minerals among many others to power our energy needs and provide the feedstock for ever advancing technology. A gasoline powered sedan requires about 50 pounds of copper, while an EV of comparable size requires 150 pounds of copper and EV batteries will drive demand for large quantities of the minerals just mentioned (Chart 5). Green cement replaces coal-based fly ash with pozzolan and metakaolin, both naturally occurring minerals with better properties. We believe that the need for these innovation era minerals will create the largest increase in mining output in history! Our supply chains are not currently capable of producing the quantities of minerals required to decarbonize and power our economy. It will likely take time, proper capital allocation and thoughtful conservation to achieve these ends.

PART 3: A tidal wave of change - investment opportunity and peril

High-level investment considerations. As we stated at the outset, the investment implications of this age of innovation cannot be overstated. Fundamental and cutting-edge advances combined with the interdisciplinary nature of convergent technologies will probably have profound implications on the upside and downside. Looking out over the next 10 years, we believe that investors will require a well-considered approach to these opportunities or face a significant risk of being left behind. The innovation moat will drive creative destruction and exponential growth for years to come. The ongoing challenge for allocators of capital is to understand the opportunities and perils and to appreciate the second and third order risks they pose to once stable, “moated” business. Innovation holds great potential for well positioned technologies but, in our opinion, is perilous for those with a good idea that is miss-timed or unable to reach scale fast enough. We expect more disparities among active managers determined by their knowledge of the exponential pace of disruption. Investment prisms should evolve away from traditional or siloed approaches in a world where companies’ total addressable markets can span multiple sectors or verticals. At the same time, new value traps may emerge as incumbent companies cede their market share and old-world assets are stranded.

Chart 5: Battery Boom

Rising EV demand supercharges demand forecasts for a group of metals.

Note: All metals expressed in metric tons of contained metal, except lithium is in lithium carbonate equivalent. Source: 13D Global Strategy & Research; BloombergNEF.

Jeff Bezos has stated “invention is the root of our success.” Market leaders of the last 20 years like Amazon and Google have built dominant, innovation platforms (the New Moat!) to become trillion-dollar companies by relentlessly upgrading themselves. Today’s innovations can redefine business and industry value propositions. It can change the way we approach investing and capital deployment as well as our personal and professional lives. That said, the sizing, timing and implementation of our allocations are essential challenges for risk management and return maximization. Our team is energized by the innovation investments we have made and our ongoing research. We look forward to an opportunity to discuss how we are deploying capital in this environment.

End Notes:

1. Peter Diamandis, executive founder of Singularity University; founder and executive chairman of the XPRIZE Foundation.

2.George Church, Ph.D., Professor of Genetics at Harvard Medical School and Professor of Health Sciences and Technology at Harvard and the Massachusetts Institute of Technology (MIT). George leads Synthetic Biology at the Wyss Institute.

3. Wright’s Law provides a basis for predicting technological progress. It states that for every cumulative doubling of units produced costs will fall by a constant percentage.

4. Peter Diamandis. Singularity University.

5. As of 2017. Peter Diamandis. Singularity University.

6. Company website. https://www.relativityspace.com/mission

7. The International Thermonuclear Experimental Reactor (ITER) is an international nuclear fusion research and engineering megaproject. It is considered the most expensive science experiment in history. Upon completion, ITER will be the largest of more than 100 fusion reactors built since the 1950s. https://www.iter.org/

8. How to Avoid a Climate Disaster. Bill Gates.

Disclosures:

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the mattersdiscussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice. Because of the many variables involved, individuals should not rely on this report alone.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Although recently updated, it originally was authored in May 2021– before The Colony Group, LLC changed its name to Focus Partners. This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Wealth, LLC (“Focus Partners”), an SEC registered investment adviser with offices throughout the country. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of Focus Partners or its representatives. Prior to January 2025, Focus Partners was named The Colony Group, LLC. Focus Partners has been part of the Focus Financial Partners partnership since 2011.

©2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-4802409

About the Author

John Paduano

Managing Director, Research