October 16, 2025

Investing Internationally in the Coronavirus Era

The Coronavirus crisis will eventually subside and the world will return to normalcy. How should American investors allocate capital overseas in anticipation of the post-crisis era?

Asia

Our international investment universe is split between countries that managed the health crisis effectively and followed conservative financial policies, and others that suffered major disruptions to their economies and were forced to cast aside financial orthodoxy. The former are mostly in developing Asia; the latter are mostly in the developed world.

This split reinforces our view that for long-term investors, the most attractive geographic region outside the United States remains developing Asia, where the Coronavirus crisis is offering an attractive entry point in a secular growth story.

As one industry professional recently pointed out, “A shift in the economic balance, away from the west and towards Asia, was well under way before Covid-19. The pandemic just accelerated it.”1

For the most part, governments in Asia (ex-Japan) have chosen not to “monetize the Covid crisis”. Unlike the United States, Europe and Japan, which have merged their fiscal and monetary policies and massively inflated their money supplies along with their debt levels, the majority of countries in Asia (ex-Japan) have followed relatively orthodox, conservative policies. Even when they engaged in stimulus programs or government-guaranteed lending schemes, these were relatively restrained.

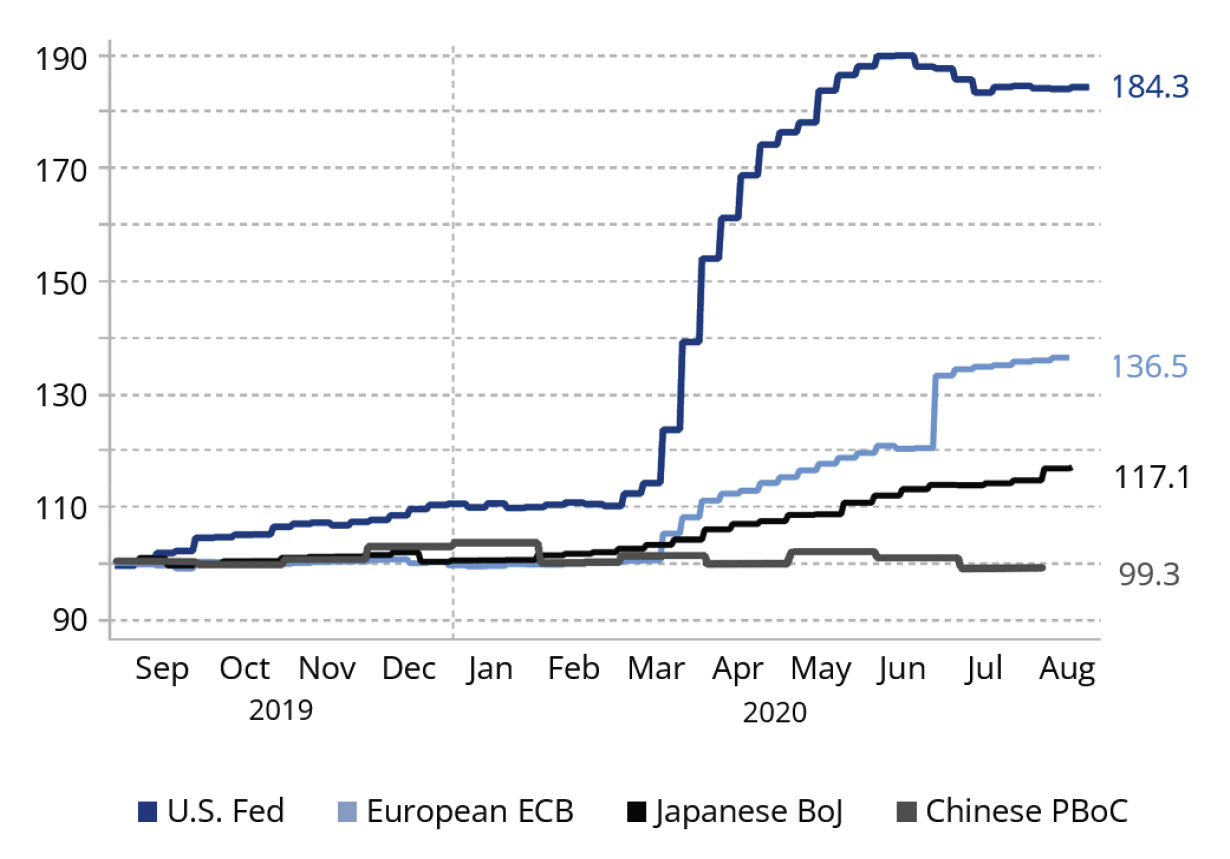

The growth of the major central banks’ balance sheets tells the story (see Chart 1).

For the most part, governments in Asia (ex Japan) have also managed the health crisis more effectively, with fewer cases, lower mortality rates and in particular in North Asia, fewer economic disruptions. Even in the countries where the virus spread has not yet been contained, such as India, the Philippines and Indonesia, the death rate is relatively low. Asia is back to work.

1 Financial Times, “Covid crisis has accelerated big trends in China’s favour” (September 2020).

Source: Gavekal Research, “The past is another country” (August 2020). In local currency, rebased at 100 in August 2019.

When the health crisis eventually subsides, in contrast with developed markets, Asia (ex-Japan) will likely return to its pre-crisis state and the next normal will be the old normal: the drivers of the investment opportunity will remain. Investors will be able to structure portfolios around economic developments, with the main drivers of growth still in place and attractive stock returns potentially available in many sectors. Fundamental investment principles will continue to apply.

In fact, we believe that developing Asia’s attractiveness as an investment destination will increase because global investors will seek in the region the secular growth that they cannot easily find in their home markets.

Our investment strategy will focus on secular growth opportunities in New Asia rather than value opportunities in Old Asia, favoring companies that benefit from the socio-economic transformations taking place around the region over state-owned businesses and old-economy stocks. Value-oriented strategies that rely solely on traditional valuation metrics, however well executed, may be unsuccessful in developing Asia because the market forces and mechanisms used to close the value gap in Western markets do not always exist or are not culturally or politically acceptable. One goes to developing Asia to seek secular growth that is not efficiently priced by the markets, quality companies that offer a good margin of safety and are run by talented entrepreneurs whose interests are aligned with those of their shareholders.

Developed Markets: Europe and Japan

In many cases, developed economies have suffered more significantly from the health crisis, with higher death rates, more damaging lockdowns, and now the threat of more disruptive “second waves” of cases.

In contrast to developing Asia, they have also engaged in massive money printing to limit the economic impact of the crisis. Interest rates in Europe and Japan were close to zero or negative before the crisis, and given the unprecedented amount of stimulus, in our opinion, it will be hard to normalize monetary policy. There will likely continue to be more capital than demand for capital, and rates could remain abnormally low for a while. While low rates may keep governments solvent, they have many negative effects:

- They have a negative impact on banks, which find it more difficult to earn a spread. It is hard for a region to build a healthy economy with unhealthy banks.

- They have a negative impact on industry and business, as low rates allow industrial projects with low potential growth and low marginal returns to get financed, creating zombie companies that ruin margins for their entire sector. Capitalism does not work well without a hurdle rate for investments.

- They have a negative impact on investments and productivity. Low rates induce companies to practice financial engineering and buy existing assets rather than invest in new, productive ones.

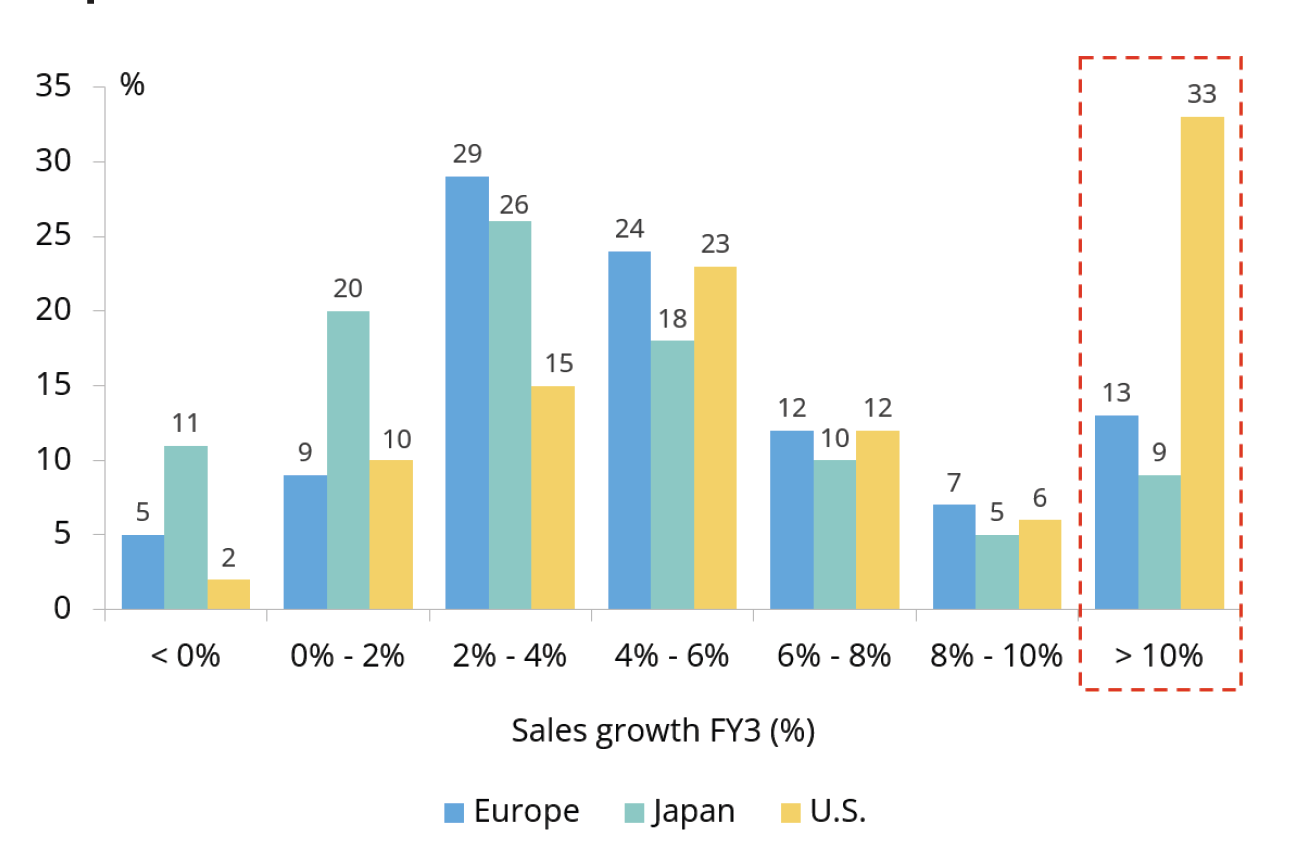

Thus, the crisis will probably further restrict economic growth and in turn, for Europe and Japan, the next normal may not be normal. Growth was already hard to find in Europe and Japan before the crisis. As shown in Chart 2, companies accounting for just 13% of STOXX 600 market cap were expected to grow sales by 10% or more in FY3 on consensus forecasts while the S&P 500 had three times as much.2

Source: Goldman Sachs Research (May 2020)

Our investment strategy in these developed economies aims to revolve around managers able to find opportunities in a challenging economic context. We believe that if rates remain “lower for longer”, growth stocks will remain extremely valuable because lower rates will increase the discounted value of their future earnings. This will justify the high valuations of growth companies that we have seen in the recent past. What is rare becomes more valuable. If earnings growth remains hard to find, we believe it will remain very valuable.

We plan on continuing to invest more in Asia (ex-Japan) than in Europe and Japan. We will have exposure to these developed economies through managers able to focus on niche, underappreciated growth sectors or on companies creating value through business and governance improvements. We believe that concentration will be key and we will try to avoid mechanical factor strategies leading to very diversified portfolios. Careful stock selection will likely become even more important given that the overall trends will not be favorable. Thus, we will continue to focus on managers with a very deep understanding of what they own and why they own it.

While inflation does not seem to be a threat in the short term, one has to acknowledge that a new dynamic is now in place in developed economies. The government-guaranteed bank lending programs and the monetization of fiscal deficits appear to be resulting in an unprecedented growth of the money supply. In the long term, this new dynamic may lead to a change in investment regime and a shift in the relative performance of growth versus cyclical or value stocks. This is not a source of concern for now but we believe it bears monitoring.

2 Goldman Sachs Research (May 2020)

Disclosures:

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Although recently updated, it originally was authored in October 2020– before The Colony Group, LLC changed its name to Focus Partners. This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Wealth, LLC (“Focus Partners”), an SEC registered investment adviser with offices throughout the country. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of Focus Partners or its representatives. Prior to January 2025, Focus Partners was named The Colony Group, LLC. Focus Partners has been part of the Focus Financial Partners partnership since 2011.

©2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-4696154

About the Author

Frank Brochin

Chief Investment Officer, Family Office