August 18, 2025

Monthly Investment Commentary: August 2025

The S&P 500 notched new all-time highs in 10 of the 22 trading days in July. It’s a remarkable rebound from the fear that gripped the market just three months prior. While the returns are a cause for celebration, it’s reasonable to wonder if things have gone too far, too fast.

New market highs tend to trigger familiar concerns. Investors worry they’ve missed the rally, that valuations are stretched, and that buying now is more a risk than an opportunity.

But as is often the case in markets, the story is more complicated, and the data more surprising.

Market Highs Have Not Been Bad Entry Points

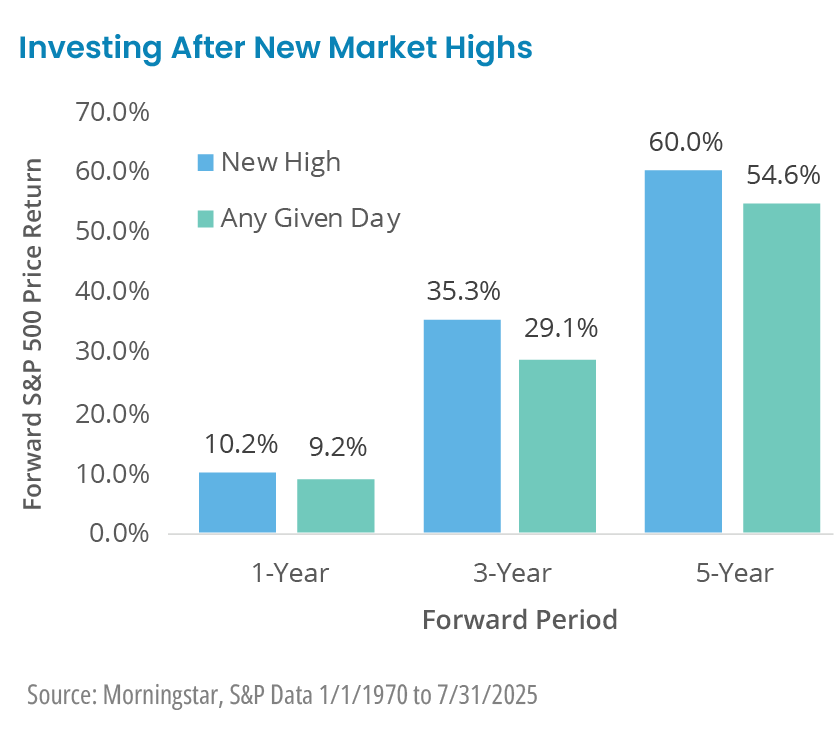

Historically, buying at a market high has not been the mistake investors assume it is. In fact, forward returns following new highs have outpaced those from randomly timed investments. On average, investors have been better off putting capital to work during market highs than sitting in cash and waiting for a pullback.

This doesn’t mean new highs guarantee future gains, but it does suggest that strong markets often reflect strong fundamentals, and that price momentum can be a sign of underlying health, not irrational exuberance.

Valuation Doesn’t Predict the Short Term

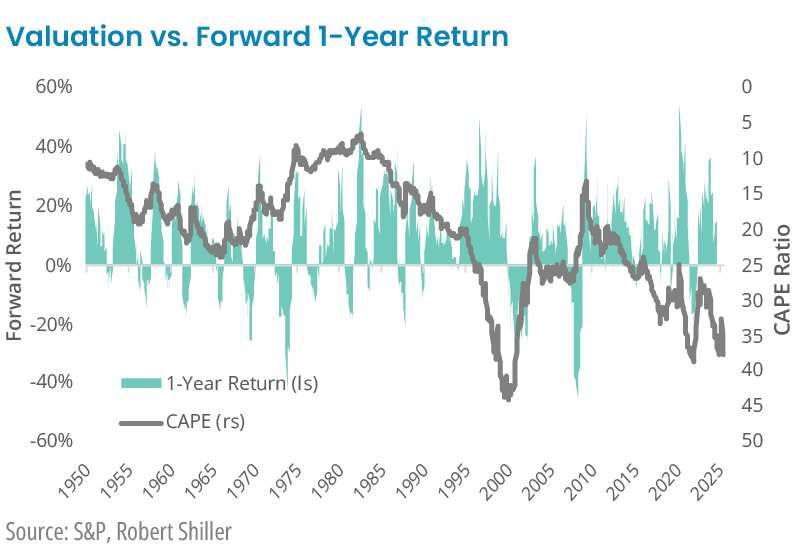

That brings us to valuation. It's easy to point to traditional measures like the Shiller CAPE ratio and conclude that markets are expensive. But expensive relative to what?

Valuation has been an ineffective short-term indicator. As the chart shows, there’s almost no historical relationship between starting valuation (CAPE) and market performance over the subsequent year. High valuations have led to strong returns, weak returns, and everything in between. In the short run, valuation tells us almost nothing about timing.

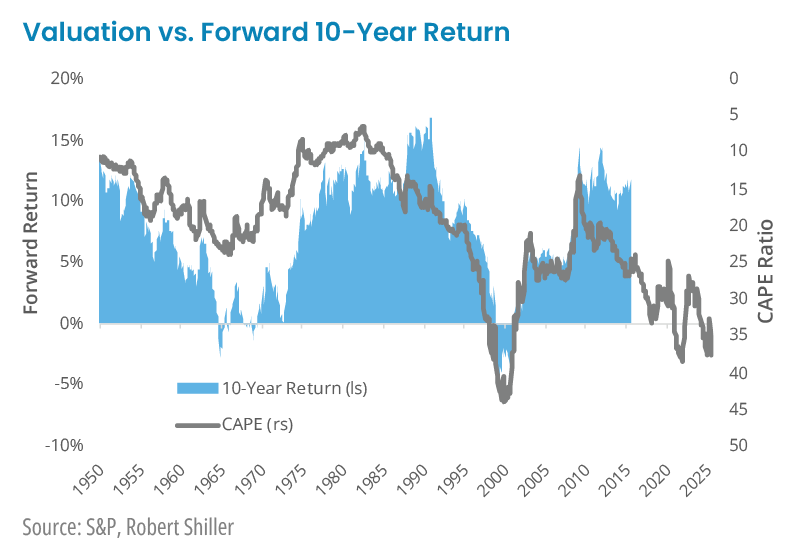

Over Longer Horizons, Valuation Adds Context

Stretch the time horizon, and valuation becomes more useful. Looking at 10-year rolling returns, high starting valuations have tended to result in lower, but often still positive, forward returns. Lower starting valuations have often led to higher returns. However, the correlation is not perfect, and other factors can influence future returns.

Valuation doesn’t tell us what will happen next, but it can inform us over time. It’s context, not signal.

There Are Two Ways to Cure a High Multiple

When valuations are a concern, it’s worth remembering there are only two ways to bring them down: prices can fall, or earnings can rise.

Lately, we’ve been seeing more of the latter. With about two-thirds of S&P 500 companies having reported, FactSet notes that 82% have delivered positive earnings surprises. We’re now tracking toward a third straight quarter of double-digit earnings growth. That is well ahead of the 4.9% growth expected at the end of June.

High valuations start to look more reasonable when earnings are improving, especially when this growth exceeds expectations. Earnings are the denominator in the price-to-earnings (P/E) multiple formula, and differences from expectations shift the entire equation.

It is also possible that valuations are sustainably higher now than in the past, possibly due to a combination of factors (lower cost to invest, better diversification, or investors having a higher risk tolerance now).

What This Means for Investors

Ironically, investors can find themselves as fretful over high prices as they do over low ones. The former feels unsustainable while the latter has typically followed periods of loss. Many investors become skeptical as the market moves higher and cautious on the way down. However, often the best buying opportunities are the ones that feel most uncomfortable in real time.

The right question to ask isn’t whether markets are at highs or whether valuation looks stretched. It’s whether your investment horizon is long enough to allow the market to do what it has done more often than not: reward discipline, patience, and participation.

For short time horizons, valuation can be hard to ignore. However, if you’re in it for the long haul, what matters most isn’t where you started; it is having the discipline and patience to get where you’re going.

Click here to download the August Monthly Investment Commentary.

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment, tax, or legal advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. Investing involves risk, including, but not limited to, loss of principal. Asset allocation and diversification may be used in an effort to manage risk and enhance returns. However, no investment strategy or risk management technique can ensure profitable returns or protect against risk in any market environment. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Any index or benchmark shown or discussed is for comparative purposes to establish current market conditions. Index returns are unmanaged and do not reflect the deduction of any fees or expenses and assumes the reinvestment of dividends and other income. You cannot invest direc

tly in an index. This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication. Please be advised that Focus Partners only shares video and content through our website or other official sources. Services and investment advice are only provided pursuant to an advisory agreement with the client.

©2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-4736461

Category

InvestingContent Topics

About the Author

Jason Blackwell

Chief Investment Strategist