July 07, 2025

Redefining Growth and Value Investing

Redefining growth and value investing challenges the traditional notion of value investing and the reliability of historical investment tools in a world driven by technological advancement and disruption.

Investors of capital in 2020 must proactively confront and respond to the rapid convergence of technological innovation and disruption, and its impact on the reliability of historical investment tools, assumptions and lenses employed. A recalibration of core aspects of an effective investment management approach includes redefining the essential elements of “growth” and “value”. In addition, the value of future earnings and cash flow are fundamentally impacted by interest rates and inflation which are at the lowest levels in the investment experience of all investors. As a result, it is likely that price earnings ratios will establish themselves at higher levels than the 15x-16x that has been the historical average. Businesses with superior and sustainable growth rates will deserve a premium equity valuation. In this environment of higher equity valuations, knowing what to pay for a stock will require manager skill at evaluating both the level, and importantly, the duration of the growthrate.

Several decades ago, Morningstar developed investment style boxes, bringing terms like growth and value investing into the lexicon of investors. Today these labels need recalibrating. Take Amazon, as an example, which started as an online book seller in 1994 but with aspirations and ambitions that were much greater. Most retail sector investments would be labeled value investments, but Amazon is impacting a far wider swath of industries, having evolved into supermarkets, pharmacies, payments, lending, as well as technology via their cloud computing business, Amazon Web Services. The retail analyst who started covering Amazon is unlikely to be well equipped to also cover the health care and technology aspects of the business. Tesla is covered by auto analysts, but that lens is too narrow for a company redefining transportation, technology and energy, which is why we think an evolution in thinking and analysis is required.

Growth Investing

The traditional definition of growth investing focused on an above-market rate of growth in revenues, earnings, or cash flow, with a corresponding trade-off of a higher valuation. However, the pace of disruption is so advanced now that one’s analysis must become broader, addressing the total-addressable-market (TAM) size, sustainability, duration and consistency of the growth rate, as well as the barriers to entry of the underlying business model. Disruptive innovation has accelerated the paradigm in which a franchise’s intrinsic value can be overwhelmingly derived from intangible assets and pioneering innovation that will ultimately drive future cash flow generation and growth. We are experiencing an explosive increase in our interaction with a digital world wherein companies create value through continuous innovation and more efficient use of capital as opposed to additional capital expenditures on physical plant and equipment.

Apple’s iPhone is just 13 years old, and it has already permanently changed the following industries: news and newspapers, photography, music distribution, computers, television, wireline communications, transportation and accommodations. Google and Facebook have, in a short number of years, garnered the majority of all online advertising running through their platforms. Tesla has transformed the concept of a car and has designed and produced a firstgeneration autonomous vehicle. As the world evolves from cash to electronic and digital payments, Visa, Mastercard and PayPal have become dominant global brands. Each of these businesses address massive TAMs and have made themselves vital, enhancing the sustainability of future cash flow growth. The next generation of artificial intelligence will bring a new set of opportunities, perils and with it new analytical tools.

Value Investing

The traditional definition of value investing evolved from Ben Graham’s seminal book, The Intelligent Investor, which equated value to paying a “low” price for a stream of cash flows or an asset, which provided the investor a “margin of safety” until the price reverted to its historic mean valuation. Today, value investing’s core tenet of a margin of safety is established by a technologically and competitively privileged business position and the resulting durability of its value creation prospects rather than metrics such as statistical cheapness, tangible asset values, or financial engineering. Conversely, the disruption of incumbent business models and even entire industries means that traditionally “cheap” companies increasingly carry the risk of getting cheaper as they cede their market share and earnings. Historical frameworks that associate value investing with low price-to-book and/or rely on reversion-to-the-mean to catalyze appreciation are too narrow to capture the opportunity set available in this environment. Traditional value opportunities will still arise as greed and fear swing markets from euphoria to panic and industries and companies suffer idiosyncratic dislocations. However, maximizing long-term wealth creation may require investors to deprioritize traditional “value” metrics and ensure their investment framework captures companies with robust trajectories towards becoming future leaders in their respective markets.

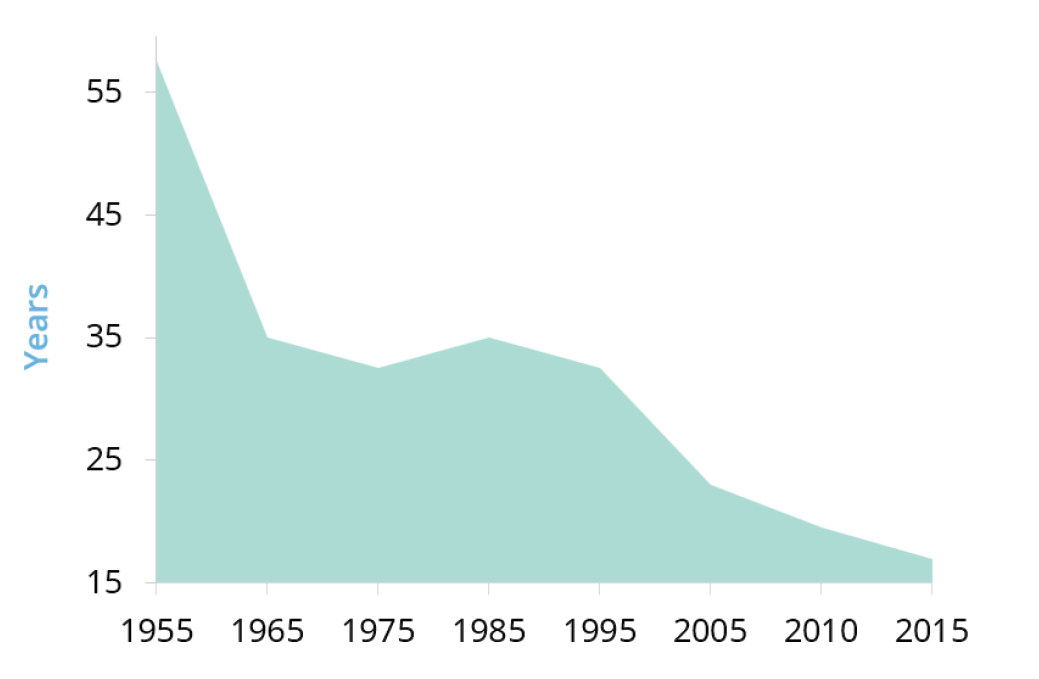

The average lifespan of an S&P 500 company has declined over the past 60 years from 50 to 17 years (Chart 1). Of course, some of this is due to M&A activity, but much of it is from bankruptcy and the expiration of old business models. Joseph Schumpeter’s theory of “creative destruction” is alive and well. Witness what Amazon has done to traditional retailers, including the likes of recent bankruptcy filers such as: JCPenney, Sears, Neiman Marcus, J.Crew, and Pier 1 Imports. The era of capital-intensive “big box” stores has been radically altered by shopping from your couch for anything you want via Amazon, now the most dominant brand in retail.

Chart 1: Average Lifespan of an S&P 500 Company

Source: RiskHedge

Evolving One’s Moat

The New York Times (The Times) is a value investing success story, significantly outperforming peers and the broad market. In 2013, The Times management commissioned a study on the future of news and the results were grim. Subscribers were canceling newspaper subscriptions for web-based news and The Times, a premier brand, faced an existential crisis. The Times’ management recognized they needed to embrace a digital transformation, that their moat had evaporated, and their barrier to entry was not distribution of a physical paper but rather the platform agnostic content they provided. As a result, The Times changed their compensation scheme, formatting, started a paywall and five years ago reached 500,000 digital subscribers.1 Today that number is 10x higher, and the incremental margin on each additional subscriber is much higher than the newsprint model.

NextEra Energy is a utility, but unlike many peers their adaptation has been to embrace solar and wind farms. NextEra recognized the future would move toward renewable energy and that the cost curve for production would come down dramatically with technological improvements. While the last decade has been challenging for most utility company returns, NextEra has nearly doubled the return of the broad market and still trades at an attractive value of 12.6x cash flow.2

Evaporating Moats Leave Stranded Assets

Eastman Kodak is a classic example of a once dominant business that failed to recognize or embrace change. Kodak invented digital photography but was so reliant on the sale of photographic film they ignored the critical disruption that was occurring in their own industry – a progression to digital, with or without them. The Apple iPhone ushered in the era of digital photography with a better platform, leaving Kodak to a quick demise.

Blockbuster Video also failed to evolve, most notably when chairman Jim Keyes said in December 2008 “Netflix is not on our radar screen in terms of competition.” This naïve complacency proved catastrophic as Netflix revolutionized the delivery of video entertainment by transforming to digital distribution in 2010. Blockbuster filed for bankruptcy shortly thereafter and in the ten years since Netflix has increased its revenues 12x to over $20 billion in annual sales.2

The concept of “Peak Oil”, coined by King Hubbert to describe the peak of oil production, has also fallen prey to technological disruption. A mere twelve years ago it was generally thought that the world was at, or near, peak oil supply. Now, it is more synonymous with a peak in oil demand as supply constraints have been rendered moot by technology and new sources of energy become cheaper via technological evolution. This raises longer term questions for the oil and gas industry as to whether its existing assets will eventually be stranded and rendered less valuable, if not worthless.

Where We Find Value Today

Kodak and Blockbuster capture the cautionary tale of a shrinking moat, a stranded asset and diminished value, but they also reflect on management’s lack of agility and perception of the future. In both of these cases and many more, statistical cheapness alone was not a sufficient reason to invest because the core business itself had been rendered obsolete, which raises one of the great risks in investing, the permanent impairment of capital disguised as value.

We are not eschewing value investing, rather we are highlighting the need for greater awareness of the pace of change and the sustainability and duration of a business model. A few areas where we see compelling opportunities for value investing include:

- Private equity can be successful as management and owners are incentivized to improve operations and embrace change for the purposes of remaining relevant, viable and profitable.

- Developing Asia remains an attractive combination of value and growth as equity market valuation multiples are several points lower than developed economies but with longer duration growth trajectories.

- Cash yielding, non-equity correlated investments that have idiosyncratic drivers of return is another area of focus. Examples include a royalty investment producing an annual double-digit net cash yield with an option for capital appreciation upon the sale of the intellectual property; and/or a life insurance settlement investment where domain knowledge benefits the manager who can source and buy policies from the highly diffuse tertiary market to generate mid-teen net returns.

Our conclusion is that to generate strong risk-adjusted returns over the coming years we and our managers must adapt. The shifting investment landscape requires us to recalibrate our tools, it requires agility, a new valuation prism and it requires avoiding antiquated paradigms that have been rendered obsolete. Practically speaking, it means embracing disruption and the companies that are creating it. This is how we are positioning portfolios.

End Notes

1. The Guardian

2. Bloomberg

Disclosures:

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice. Because of the many variables involved, individuals should not rely on this report alone.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary.

The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Although recently updated, it originally was authored in July 2020– before The Colony Group, LLC changed its name to Focus Partners. This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Wealth, LLC (“Focus Partners”), an SEC registered investment adviser with offices throughout the country. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of Focus Partners or its representatives. Prior to January 2025, Focus Partners was named The Colony Group, LLC. Focus Partners has been part of the Focus Financial Partners partnership since 2011.

©2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-4802409

Category

InvestingAbout the Author

Pier Friend

Chief Investment Officer, Institutional Advisory Practice