October 27, 2025

What to Do With an Inherited IRA: 6 Options to Consider

Inherited an IRA? Whether you’re planning to leave one to your adult children or have recently inherited one, knowing your options is key. Learn 6 strategies to manage distributions, minimize taxes, and maximize your inheritance.

What should you do with an inherited IRA? Explore 6 options that can help you maximize value, reduce taxes, and avoid costly mistakes.

When you inherit a retirement account—like an IRA—from a parent, you may quickly realize there are a lot of tax rules to navigate. The way you’re taxed depends on the deal your parent originally made with the IRS. For most, that means contributions were made on a tax-deferred basis, so any withdrawals you make are fully taxable as ordinary income.

The IRS doesn’t let tax deferral last forever. They require you to start taking money out within certain time frames, and each withdrawal is subject to federal and (often) state income tax. That can feel frustrating, but it also creates opportunities if you plan wisely.

Why Tax Diversification Matters

Over the past few decades, most people have shifted from pensions to retirement accounts like 401(k)s, 403(b)s, and IRAs. That gives today’s beneficiaries more choices. However, it also means you need to be thoughtful about where and how you save.

Because tax laws are constantly changing, one way to protect yourself is through tax diversification. This means holding money in three different types of accounts:

- Taxable accounts (brokerage accounts)

- Tax-deferred accounts (401(k)s, traditional IRAs)

- Tax-free accounts (Roth IRAs, HSAs)

When you inherit an IRA, it’s worth asking: Which bucket should I add to?

What to Do If You Don’t Need the Cash Right Away

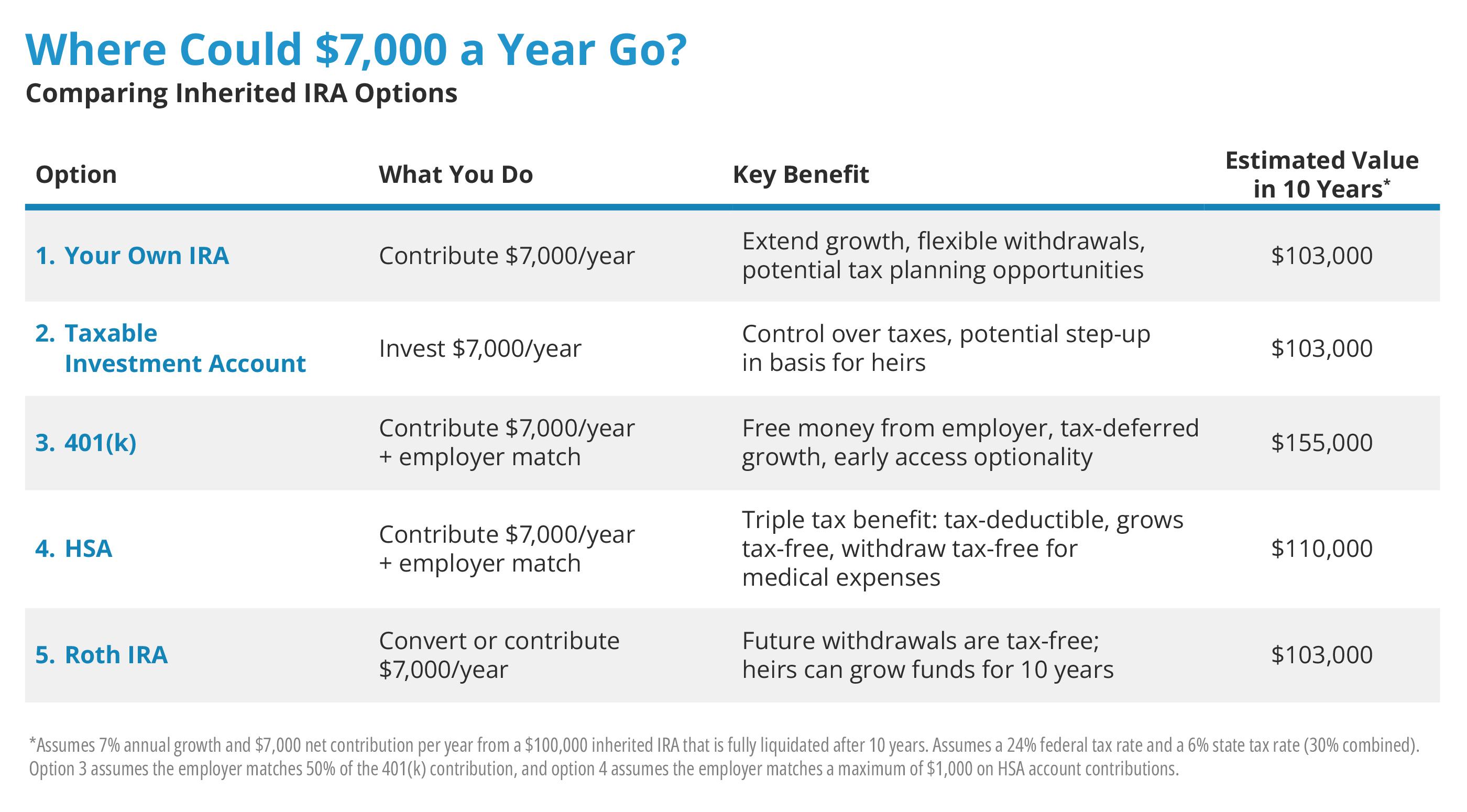

Let’s imagine you inherit a $100,000 IRA. If you withdraw $10,000 per year, about $3,000 might go to taxes, leaving you with $7,000 to invest elsewhere. How you choose to reinvest that $7,000 can make a huge difference over time.

Here are your main options:

Option 1: Contribute to Your Own IRA

- You can put your $7,000 into your own IRA.

- If your income is too high for a deductible IRA, you might use the backdoor Roth IRA strategy, which turns nondeductible IRA contributions into tax-free Roth dollars.

- This allows retirement money to keep growing and gives you flexibility to manage withdrawals when you reach retirement age.

- If you’re in a lower tax bracket once you begin taking distributions in retirement, you’ll likely save on the tax rate difference.

- You can also use your IRA funds to pay for long-term care expenses in a tax-advantaged way.

Option 2: Invest in a Taxable Account

- A taxable account has no contribution limits or restrictions.

- You’ll have more flexibility in how your investments are taxed. Capital gains and qualified dividends may be taxed at lower rates than IRA withdrawals.

- Assets in a taxable account often get a step-up in basis when you pass them on, potentially reducing taxes for your heirs.

Option 3: Boost Your 401(k)

- Contributing to your employer plan means you may also get a company match (free money).

- In 2025, you can contribute up to $23,500 ($31,000 if you’re 50+).

- Some plans allow earlier access (as early as 55 if you leave the job).

Option 4: Fund an HSA (Health Savings Account)

- Some employers offer HSAs to employees enrolled in HSA-eligible high-deductible health plans.

- HSAs offer a triple tax benefit: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- You can even reimburse yourself later for expenses you paid out-of-pocket, letting your HSA dollars grow in the meantime.

Option 5: Build a Roth IRA

- If you meet the eligibility requirements to contribute to a Roth IRA and follow the qualified distribution rules, your future withdrawals can be completely tax-free.

- If your heirs inherit your Roth, they’ll enjoy up to 10 years of tax-free growth before needing to withdraw funds.

Option 6: Take More Distributions in Low-Income Years

- If you have a year with lower income—like a sabbatical, career break, or temporary job loss—it may make sense to take larger withdrawals.

- This can reduce your long-term tax bill and free up funds to put into a Roth IRA or other tax-advantaged accounts.

Make Sure to Choose Wisely

An inherited IRA is a chance to reshape your own retirement strategy. By choosing wisely where to put your withdrawals, you can:

- Reduce your lifetime tax bill

- Diversify across different tax “buckets”

- Build wealth for future generations

And while the loss of the old “stretch IRA” option has limited long-term deferrals, today’s planning strategies offer flexibility and tax-saving opportunities that didn’t exist before.

To make the most of your inherited IRA, it’s important to create a thoughtful plan. This will make a big difference for your retirement—and for the generations that follow.

This communication is for informational purposes only. The content does not purport to present a complete picture, but Focus Partners believes the information is representative of issues and needs facing some clients. This should not be construed as specific investment, tax, or legal advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This represents the opinions of Focus Partners, may contain forward-looking statements, and presents information that may change. Nothing contained in this presentation may be relied upon as a guarantee, promise, assurance, or representation as to the future. Investing involves risk, including, but not limited to, loss of principal. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Advisor Solutions, LLC and Focus Partners Wealth, LLC (collectively referred to in this document as “Focus Partners”), SEC registered investment advisers. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of the RIAs or their representatives. ©2025 Focus Partners Wealth, LLC and Focus Partners Advisor Solutions, LLC. All rights reserved. RO-25-4894866

Category

RetirementContent Topics

About the Author

Gary Willard

Tax Manager