December 15, 2025

Using QCDs to Unlock the New Senior Tax Deduction

The One Big Beautiful Bill Act (OBBBA) has brought about many new tax planning opportunities and challenges. With the arrival of a new temporary senior deduction, taxpayers age 65 and older should start discussing ways to manage their modified adjusted gross income (MAGI) with their tax preparer now.

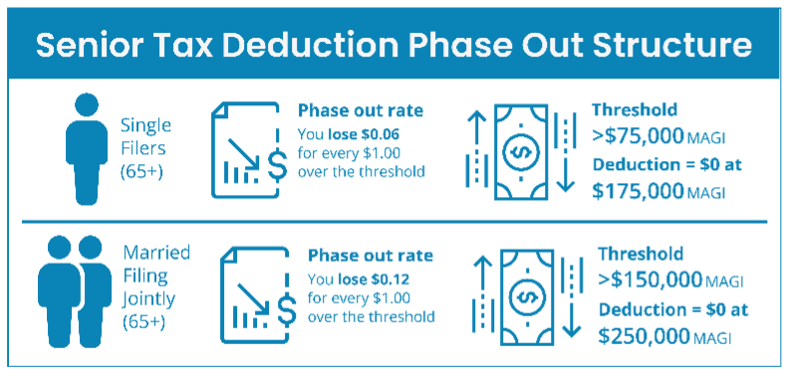

The deduction, available for tax years 2025-2028, offers up to $12,000 if married filing jointly and $6,000 for all other filers. Unfortunately, the deduction has a low phaseout range of $150,000-$250,000 if married filing jointly and $75,000-$175,000 for all others.

For many seniors with required minimum distributions (RMDs), pensions, Social Security benefits, and investment income, falling into the phaseout range can happen all too easily. That is where qualified charitable distributions (QCDs) come into play. Here’s how you may be able to use QCDs to unlock the new senior tax deduction.

Why QCDs Matter Now More Than Ever

A QCD allows taxpayers age 70½ and above to have a portion of their RMD paid directly to charity. By doing this, the RMD is satisfied for the calendar year, and the portion sent directly to charity is excluded from income. To put it another way, QCDs act as pre-tax income that never gets taxed, making them a very stable and effective tax planning tool.

In order to take advantage of QCDs, you must:

- Be 70½ or older at the time of the distribution.

- Send funds directly from an individual retirement account (IRA) custodian to charity.

- Use a traditional IRA or inherited IRA (beneficiary must be at least age 70½).

- Follow annual limits ($108,000 per taxpayer in 2025, indexed for inflation).

What are the Key Benefits of QCDs?

- You get the tax benefit even if you don’t itemize.

Most seniors take the standard deduction, which means they get no tax benefit from charitable giving. A QCD, however, reduces taxable income directly.

- QCDs lower AGI—and lower AGI opens many doors.

Reducing AGI can help you:

- Lower or avoid Medicare income-related monthly adjustment amount (IRMAA) surcharges.

- Potentially reduce the taxable percentage of Social Security benefits.

- Preserve deductions and credits that phase out at certain income levels.

- Stay within the MAGI window for deductions and credits, such as the senior deduction or the state and local tax (SALT) cap.

- QCDs satisfy your RMD.

This avoids adding taxable income from RMDs, which is one of the biggest reasons seniors will exceed the phaseout threshold.

- QCDs bypass future deduction limits.

While many younger taxpayers will need to look to bunching charitable donations in 2025 to maximize their itemized deductions, QCDs bypass certain limitations, including the 0.5% AGI floor and the 35% overall tax savings on itemized deductions effective beginning in 2026.

Hypothetical Client Example: The Kufelds

Tony and Karen Kufeld are both 73 years old, married, and file jointly. They have the following income for 2025:

- Social Security Income: $70,000 (taxable portion)

- Taxable Interest and Dividend Income: $30,000

- Taxable Retirement (Pension/IRA) Income: $150,000

- Total Gross Income (before AGI calculations): $250,000

Scenario 1: No QCD; $100,000 cash donations to charity

Without a QCD, their MAGI is $250,000. They end up in the 22% marginal tax bracket, and their MAGI is too high for the senior deduction. The charitable donations help shield some income taxed at high tax rates, but they still pay federal income tax of $22,828, an effective tax rate of 15.2%. At this income level, they are also facing tier two of the IRMAA surcharges and will have surtaxes pushing their monthly Medicare premiums to $259 per month.

Scenario 2: With a $100,000 QCD

The $100,000 QCD acts as a pre-tax deduction, and lowers MAGI to $150,000, allowing the full $12,000 senior deduction on top of a standard deduction of $34,700. They pay only $12,554 in federal tax, saving them over $10,000 on taxes compared to Scenario 1. The QCD has an additional benefit of making Tony and Karen’s income low enough that they will not face any Medicare surcharges for 2025.

The Roth Conversion Trade-Off: A Key Planning Decision

Another popular tax planning strategy for those 65 and over involves using Roth conversions to fill in a low tax bracket and leave surviving family members with tax-free assets. Unfortunately, Roth conversions and the new senior tax deduction do not work together in tandem. Roth conversions increase MAGI, which may reduce or eliminate the senior deduction. So, is it better to prioritize the senior deduction now, or Roth tax-free growth?

Like many tax scenarios, the answer is it depends. For some taxpayers, preserving the OBBBA deduction for four years could save thousands. For others, long-term Roth benefits may outweigh the short-term deduction. This decision requires a tailored analysis.

Other Ways to Reduce MAGI to Maximize Senior Tax Deductions

Even high-income households can reposition income to stay within the MAGI phaseout thresholds. Strategies can be layered, and include methods such as:

1. Strategic loss harvesting

- Realize losses to offset gains.

- Wait 31 days to avoid wash sale rules.

2. Shift the portfolio to municipal bonds

- Tax-free income for federal purposes.

- May reduce taxable portfolio income.

- Will not help reduce taxable Social Security benefits or Medicare premiums.

3. Defer income

- Delay capital gains into a future year, if possible, or consider donating appreciated securities to charity.

- If you need liquidity, consider selling long-term capital gain securities before taking additional retirement distributions. Retirement plan distributions are taxed as ordinary income up to a 37% tax rate, whereas long-term capital gains are taxed at a maximum of 23.8%.

Bottom Line

Even if you’re a high-income senior—or if you have taxable and tax-deferred investments—you may still qualify for thousands in new deductions under OBBBA if you plan ahead. Because the senior deduction only applies from 2025–2028, the window is short. That means decisions about making QCDs, timing your RMDs, and using Roth conversions matter more than ever.

Reach out to your financial advisor and tax team to determine how much of the new senior deduction you may be eligible to receive and what planning steps can maximize your benefit. If you’re not currently working with an advisor or tax team, contact us today. We would be happy to help.

This communication is for informational purposes only. All tax laws and regulations discussed are subject to change. The content does not purport to present a complete picture, but Focus Partners believes the information is representative of issues and needs facing some clients and why they may seek our services. This should not be construed as specific investment, tax, or legal advice. Individuals should seek advice from their wealth advisor, tax advisor, or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This represents the opinions of Focus Partners, may contain forward-looking statements, and presents information that may change. Nothing contained in this presentation may be relied upon as a guarantee, promise, assurance, or representation as to the future. Investing involves risk, including, but not limited to, loss of principal. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Advisor Solutions, LLC and Focus Partners Wealth, LLC (collectively referred to in this document as “Focus Partners”), SEC registered investment advisers. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of the RIAs or their representatives. Prior to January 2025, Focus Partners Advisor Solutions was named Buckingham Strategic Partners, LLC, and Focus Partners Wealth was named The Colony Group, LLC.

©2025 Focus Partners Wealth, LLC and Focus Partners Advisor Solutions, LLC. All rights reserved. RO-25-5042154

Authors:

Aaron Choi, Senior Tax Associate

Sean Kelly, CPA, MST, MSFP, MSM, Senior Director, Tax Services

Ahmed Ismail, Senior Tax Associate