November 03, 2025

The Base Case for India

The investment opportunity in India is driven by some of the same social and economic transformations that have been taking place in China and Southeast Asia over the past several decades. India is particularly well positioned in Asia because of its very favorable demographic profile, longer potential runway of growth, stable and democratic political institutions and reasonably well-developed financial system.

The Big Picture: Long-Term Investment Drivers

Rising urban middle class and increasing consumption. India is following a similar development path to that taken earlier by the more economically advanced northern Asian countries. Its population is transitioning from traditional agriculture to “modern” industry and from rural areas to urban centers. Economic productivity is increasing, people are earning more and spending more, leading to a significant increase in private consumption and fueling the growth of many companies.

These growth drivers should persist for at least two decades as the urbanization level in India is still relatively low, only 34% compared with 82% in the United States,1 and tertiary employment still very high, with nearly 50% of the working population involved in agriculture compared with only 2% in the United States.2

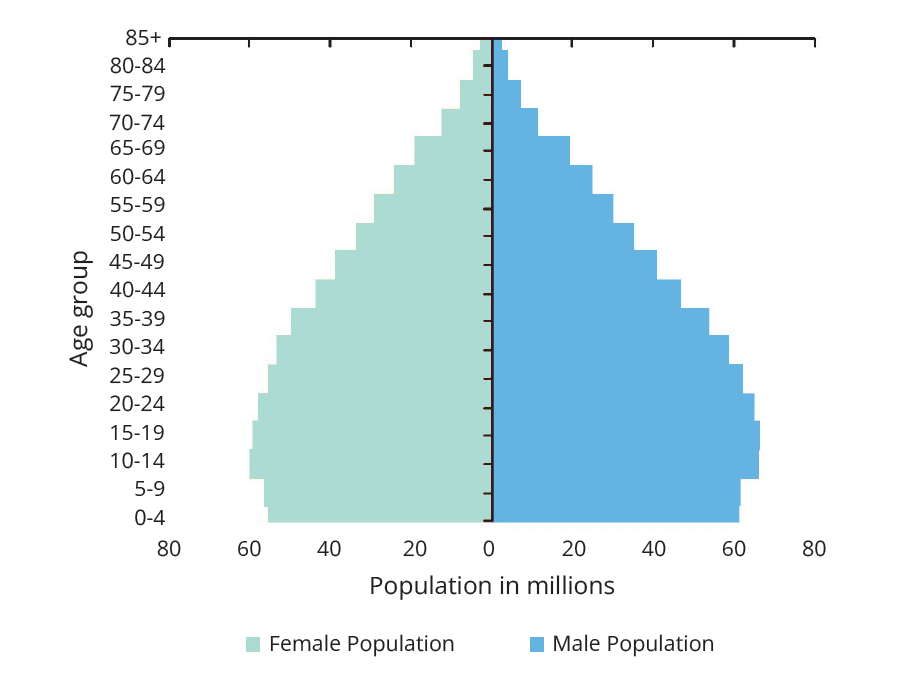

Large, young, and growing working population. India is particularly well positioned in Asia because of the size and growth of its working population. India’s current population of 1.3 billion people is projected to rise to 1.6 billion by 2050.3 Approximately half of Indians are younger than 25 years old, nearly twice the population of the United States, and nearly two-thirds are less than 35 years old.4 The population pyramid for India (Chart 1) shows a bulge in the 10-24 age cohorts, implying that the incremental increase in India’s labor force each year will continue to be significant for the next few decades.

The growth in the working population is expected to result in a significant increase in consumer demand, higher tax revenues for the government and a better fiscal position. It will also increase the country’s aggregate savings, which will expand the availability of domestic financing for growth.

Chart 1: Indian Population Age Structure

Source: “Demographic changes and their economic ramifications in India”, Reserve Bank of India bulletin (July 2019).

In India, household expansion is actually higher than population growth, as social practices are evolving and multi-generation families are no longer living under the same roof. Thus, while the population is currently growing at 1.1% annually,5 the “nuclearization” of families is driving household expansion in urban areas by around 4% per year,6 an important driver of incremental demand for a variety of goods and services and a significant factor of economic growth.

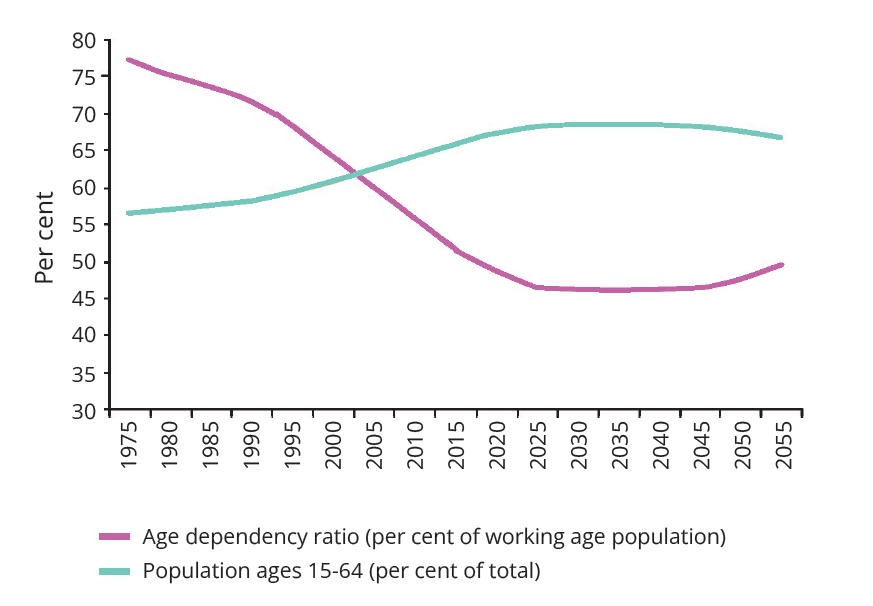

Low age-dependency ratio. Even more importantly, for the next few decades, India will benefit from a significant demographic dividend because of its low age-dependency ratio (a lower value implies a more productive population). The ratio of total dependent population to total working age population is expected to decline until 2025, after which it will remain low and stable until at least 2040 (Chart 2).

In the past, this same shift in population structure initially drove higher economic growth in other countries such as Japan (starting in 1964), Korea (starting in 1987) and China (starting in 1994).7

Long runway of growth. While the country is modernizing rapidly, it is still in the early stages of its development and its social and economic transformation has a long way to run. With approximately $2,000 of GDP/capita, compared with $2,600 in Vietnam, $3,100 in the Philippines, $3,900 in Indonesia, $7,300 in Thailand and $9,800 in China,8 the country has the potential to enjoy a long period of growth.

At a real annual GDP growth rate of 7% and a nominal annual growth rate of 10-11%,9 India’s $2.9 trillion10 economy could double in the next seven years. The economic opportunity is indeed substantial.

Working-age population defined as people between 15 and 64 years old. Source: “Demographic changes and their economic ramifications in India”, Reserve Bank of India bulletin (July 2019).

Democratic political system and developed financial system. For Western investors, India offers a reassuringly familiar democratic political system. It also boasts a reasonably sophisticated financial system, which is modeled on, and functions like, those in the West. Not only is India the oldest democracy in Asia, it also has the oldest stock market, the Bombay Stock Exchange, which has been operating since 1875 and is not subject to the kind of government intervention that can affect investors in other emerging countries.

While Indian state-owned banks deserve their reputation for inefficiency, the private banking sector is performing well and growing. Market considerations rather than political affiliations drive the allocation of credit from private banks to the economy.

Why Hasn't the Investment Thesis Worked Better So Far?

These long-term growth drivers have been in place for many years. Yet, stock market returns for the local Indian indices have often been disappointing from the perspective of U.S. investors. In the past decade, on an annualized basis, Indian large-caps have only delivered 4.0% per year and small-cap stocks a bare 3.6%,11 while the S&P 500 has delivered 13.2% annual returns.

This mediocre performance does not negate the longterm investment thesis. In India, investors adopting a passive allocation to the country’s stock market indices can end up disappointed as there is a mismatch between the index components and the publicly-listed companies driving economic growth. In addition, several other factors have had a negative impact on the Indian economy and the performance of Indian stocks for U.S. investors:

(i) The Indian rupee has declined by 32% against the U.S. dollar over the past 10 years, representing an annual 3.8% impact on U.S. dollar returns. We note that India’s macro parameters are improving in a way that should be more supportive of the currency in coming years.

(ii) Many reforms introduced by the government in recent years will have a positive impact in the longterm, but they were fairly disruptive in the short-term. In particular, the so-called demonetization will speed up the formalization of the economy and increase tax compliance, but it had a negative impact on small businesses after it was introduced in 2016. In a similar way, new environmental regulations for the auto industry have significantly slowed down car sales in the past year, even if they will yield a positive long-term benefit for India.

(iii) Recent reforms had a deflationary impact on the economy, but the Reserve Bank of India kept interest rates relatively high. Despite several rate cuts, India has had a tight monetary policy in the past several years and currently has one of the highest real interest rates in Asia.12

(iv) The default of a highly-rated non-bank financial company in 2018 resulted in a liquidity squeeze for the whole sector and has led to a severe decline in the availability of credit to consumers, the self-employed as well as small- and medium-sized enterprises. Non-bank financial companies helped fund 55-60% of commercial vehicle sales, 30% of passenger cars, and nearly 65% of two-wheelers in India in recent years,13 and the sharp reduction in lending has had a meaningful, but we believe temporary, impact on growth in the past four quarters.

We believe that India is facing a cyclical and short-term downturn, and that the long-term investment thesis remains intact and compelling. While the economy only grew at 5% in the second quarter of 2019, down from 8% a year before, there are a number of catalysts in place that put India at an inflection point. We discuss these below.

Why Now? Short-Term Investment Catalysts

India has recently embarked on a series of deep reforms and initiatives that will have a significant longterm impact on business and society. In the shortterm, we believe they will also lead to an acceleration of investment opportunities.

Aadhaar. The government has now enrolled more than 1.2 billion Indians in Aadhaar, a biometric digital identity program created to provide all residents of India with a high-assurance, unique, digitally verifiable means to prove who they are. Before then, most Indians relied on rudimentary physical documents as their primary source of identification, such as the “ration card” issued for food subsidies, and there was often no way to authenticate and verify the identity of ration card holders in real time.

Within a decade of its introduction, Aadhaar has become the largest single digital ID program in the world and a powerful catalyst for the broad adoption of digital services in India.14 For example, a suite of applications is linked to Aadhaar, such as the Unified Payments Interface platform, which integrates other payment platforms in a single mobile app that enables quick, easy and inexpensive payments among individuals, businesses and government agencies.

Efficient subsidies and financial inclusion. Aadhaar has also fundamentally altered the distribution of services and subsidies to the population. An important benefit has been the potential to reduce loss, fraud and theft in government programs by enabling the direct transfer of subsidies to bank accounts. It is estimated that more than 80% of public benefit disbursement accounts are now linked to Aadhaar.15

In parallel, the government has also launched a mass financial-inclusion initiative, with several hundred million people opening Aadhaar-authenticated bank accounts linked to mobile phones, resulting in more than 80% of adult Indians having at least one digital financial account.16

Business Reforms. While Westerners tend to think of India as a single country, it was until recently a patchwork of states for trade and tax purposes. The introduction of the Goods and Services Tax (GST) has transformed it into a unified economic entity. Over time, this program should facilitate trade, improve logistics, increase tax compliance and help generate more government revenue.17

Tax reform is clearly a key priority to make India attractive for business, as demonstrated by the recent government decision to simplify business taxes and reduce the headline rate of corporate tax from 30% to 22% (and as low as 15% for newly-incorporated manufacturers). India is keen to appear friendly rather than hostile to capital, and eager to attract foreign investors.

In a similar vein, the government recently introduced a new Insolvency and Bankruptcy Code to eliminate the interminable judicial procedures that used to accompany bankruptcies, and hampered credit allocation. The new regime favors banks and secured lenders over borrowers and puts the emphasis on the speed of bankruptcy resolution.

It is a fact that these business reforms have only been recently introduced and are not yet operating smoothly. However, they represent a clear path towards improvement of the business environment in India.

Inflation. Over the past several years, the macro environment for India has improved on several fronts. In particular, The Reserve Bank of India is now directly targeting inflation. In that respect, consumer price inflation has declined from 10.5% in 2013 to a recent 3.5%.

Corruption. India is cleaning up. Over the past couple of years, fighting corruption has been one of the government’s priorities. Many legal cases were filed against allegedly corrupt public servants and industrialists, several of whom, including former senior officials and politicians, are now in jail. The government has made it clear that corruption will not be tolerated.

Privatizations. The government is now planning to privatize several large state-owned companies in a broad range of industries. This could improve capital allocation, productivity and competition. It could also generate significant revenue for the State, which could then be re-invested to finance growth. This has been a contentious program that has not succeeded in the past but could represent a significant boost for India if it is implemented successfully in the coming years.

Overall, while the impact of these initiatives is still to be realized in full, it is clear that India is accelerating its transformation. The world has noticed: in the last five years, India has climbed from the 142nd to the 63rd place in the World Bank’s Ease of Doing Business report.18 In the long run, ease of doing business directly correlates with higher foreign direct investment and higher GDP per capita.

Conclusion

From a long-term perspective, we believe that India’s ongoing socio-economic transformation and attractive demographic profile will create a large pool of investment opportunities within the growing universe of Indian companies providing goods and services to the rising urban middle class.

Recent business reforms and nationwide initiatives should provide important investment catalysts. Skillful stock pickers with experience on the ground have an opportunity to generate attractive long-term returns from Indian equities.

End Notes:

1. Statista; World Bank

2.Statista; World Bank; “India economic Survey 2018”, Financial Express (January 2018)

3. “Demographic changes and their economic ramifications in India”, Reserve Bank of India bulletin (July 2019)

4. “India: an investment opportunity”, IIFL Capital (2019)

5. “Demographic changes and their economic ramifications in India”, Reserve Bank of India bulletin (July 2019)

6. CEIC, based on the last India census in 2011 showing a 3.5% annual acceleration in the 2001-2011 period, and anecdotal evidence indicating an acceleration of that trend since then.

7. "India enters 37-year period of demographic dividend”, Economic Times (July 2019)

8. World Bank

9. India’s nominal GDP growth rate has actually averaged 11.5% from June 2012 to Jun 2019, while its real GDP growth rate has average 7.6% between June 2005 and June 2019. Source: CEIC

10. Estimate for 2019. Source: World Bank

11. Performance of the MSCI India Large Cap index, and MSCI India Small Cap index, including dividends and as measured in U.S. dollars, between October 2009 and September 2019. Source: Bloomberg

12. Real interest rate in India was recently around 2.3%. Source: Bloomberg (October 2019)

13. “How a shadow banking crisis sent India’s autos sector into a tailspin”, Reuters (August 2019)

14. "Digital India: technology to transform a connected nation”, McKinsey Global Institute (March 2019)

15. Ronald Abraham et al., State of Aadhaar report 2017–18, IDinsight (May 2018)

16. “Digital India: technology to transform a connected nation”, McKinsey Global Institute (March 2019)

17. “Digital India: technology to transform a connected nation”, McKinsey Global Institute (March 2019)

18. Trading Economics

Disclosures:

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Any index or benchmark shown or discussed is for comparative purposes to establish current market conditions. Index returns are unmanaged and do not reflect the deduction of any fees or expenses and assumes the reinvestment of dividends and other income. You cannot invest directly in an index.

Although recently updated, it originally was authored in November 2019– before The Colony Group, LLC changed its name to Focus Partners. This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Wealth, LLC (“Focus Partners”), an SEC registered investment adviser with offices throughout the country. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of Focus Partners or its representatives. Prior to January 2025, Focus Partners was named The Colony Group, LLC. Focus Partners has been part of the Focus Financial Partners partnership since 2011.

©2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-4696154

About the Author

Frank Brochin

Chief Investment Officer, Family Office