March 17, 2025

Why Invest in Developing Asia

This paper is part of our series on the recalibration of investment tools and reevaluation of portfolio design. Please note, this paper was originally produced in mid-March 2020 in the early days of the Coronavirus crisis. In our opinion, the conclusions are still valid.

The Ideal Stock Market?

If one had to design the ideal stock market, what would it look like?

It would have to offer a sizable number of securities, to enable the most skilled investors to build differentiated portfolios; provide sufficient liquidity, to allow flexibility in sizing positions; present valuable trading inefficiencies and frequent mispricing of stocks, to be exploited through fundamental research; exhibit a high dispersion of returns, favoring talented stock pickers over index huggers; and be supported by a steady stream of fund inflows from large allocators.

Most importantly, the ideal stock market would benefit from secular growth trends enabling companies to compound earnings over time, thus favoring investors with a long-term horizon; it would also offer very attractive valuations, setting the foundation for significant stock returns.

Equity markets in India, Southeast Asia1 and China exhibit all these characteristics. In our judgment, they represent the most attractive universe for investors today.

Broad and deep markets. Equity markets in developing Asia2 offer a much larger universe of stocks than the markets in the United States, with more than 5,000 companies publicly listed in India,3 about 5,000 in China, and around 4,400 trading on the various stock exchanges of Southeast Asia. With growth booming across the region, more companies are listed every year and the universe of potential investments is steadily expanding.

Market capitalization is sizable. The total market value of Chinese stocks trading in Shanghai, Shenzhen and Hong Kong is currently around $11 trillion, and daily trading volumes are actually higher than in the United States. Markets in India and Southeast Asia together represent close to $4 trillion in additional capitalization.4 While small- and mid-cap companies do not always offer enough liquidity for large foreign investors, they form an attractive universe for boutique investment firms with a manageable pool of assets.

Trading inefficiencies. Markets in the region are not well researched and stocks are not priced efficiently. In Southeast Asia, the percentage of stocks covered by at least one research analyst ranges from only 6% in Bangladesh to about 34% in Malaysia,5 compared with more than 80% in the United States. Markets are also volatile, as price movements are often driven by non-fundamental factors. Thus, in Chinese domestic markets, more than 80% of trading is done by retail investors rather than professionals. This environment creates a lot of opportunities for fundamental investors to buy shares of attractive companies at times when they trade much below their intrinsic value.

High dispersion of returns. One should not invest in developing Asia through indices. Markets in the region are weighted by large, state-owned enterprises that represent the past rather than the future.

Asian markets are also characterized by a very high dispersion of returns, with winners producing outsized returns and losers sharp losses. Equity indices end up delivering mediocre averages. As in many emerging countries, market dynamics in developing Asia favor selective stock pickers over index huggers.

Supportive fund flows. China’s economy is more than 60% of the size of the United States’ economy, yet the weight of the Chinese domestic markets in the MSCI ACWI index is smaller than the weight assigned to the Swiss stock market. India’s weight in the benchmark is smaller than Ireland’s, and Southeast Asia, whose aggregate GDP would make it the 5th largest economy in the world, has an aggregate weight in the MSCI ACWI index equivalent to that of the Netherlands. In the coming years, one would expect a significant tailwind of capital flows into developing Asia as index providers such as MSCI adjust their constituent weights to reflect more fairly the market capitalizations, economic sizes and investment opportunities in the region.

Long-term growth. Equity markets in developing Asia are benefiting from secular growth trends, as the region is experiencing a wave of social and economic transformations taking place on a massive scale. These follow the path previously taken by Japan in the 1950’s and ‘60’s, followed by the emergence of the so-called “Asian Tigers”6 in the 1970’s and ‘80’s.

While the “rise of the Asian urban middle class” may be a cliché, it is nevertheless real, as anyone who has traveled to Shanghai, Jakarta, Mumbai or Bangkok over the past 30 years can testify.

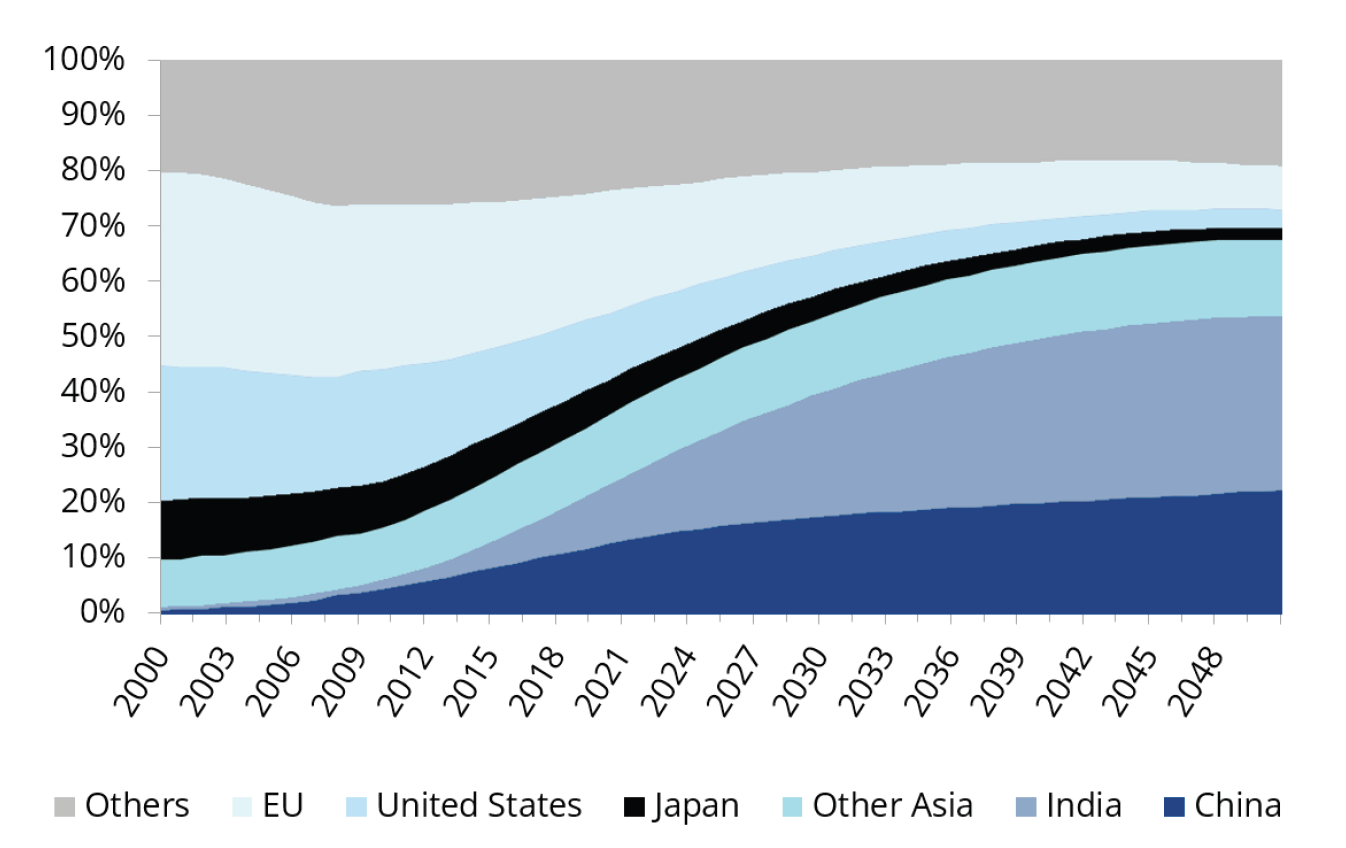

Chart 1, which depicts the growth of consumption by the middle class in Asia speaks for itself. By 2050, Asia (ex-Japan) will represent between 60% and 70% of the world’s middle class consumption. Surely, this has to be one of the most powerful long-term economic trends in the world today.

Chart 1: Shares of Global Middle Class Consumption7

Source: OECD Development Center Working Paper #285.

Asia represents a long-term investment, not a shortterm trade, and the drivers of change should remain in place for several decades. Asia is evolving very quickly and creating a once-in-a-generation opportunity.

Overall, we believe that the stock markets of India, Southeast Asia and China represent an ideal hunting ground for investors seeking to generate significant capital appreciation from equity securities.

The current market turmoil created by Coronavirus, however tragic its context may be, has resulted in valuations that are in many cases lower than at the bottom of the Global Financial Crisis in 2008-2009, and represents a very attractive entry point for those with a long-term investment horizon.

End Notes

1. We define Southeast Asia as the combination of (from west to east): Bangladesh, Sri Lanka, Myanmar, Thailand, Cambodia, Laos, Vietnam, Malaysia, Singapore, the Philippines and Indonesia. All of these countries have economies and populations relevant to our investment thesis, although not all of them offer direct investment opportunities.

2. We define developing Asia as the combination of India, Southeast Asia and China.

3. There are actually more companies publicly listed in India, but many do not offer any meaningful liquidity.

4. Compared with $29 trillion in the United States, all data as of March 20, 2020.

5. AIMS Asset Management Sdn Bhd (as of August 2019).

6. Korea, Taiwan, Singapore and Hong Kong.

7. OECD Development Center Working Paper #285. While this research paper is relatively dated, we believe that the conclusions of its 40-year forecast, produced in 2010, remain valid.

Disclosures

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice. Because of the many variables involved, individuals should not rely on this report alone.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Any index or benchmark shown or discussed is for comparative purposes to establish market conditions. Index returns are unmanaged and do not reflect the deduction of any fees or expenses and assumes the reinvestment of dividends and other income. You cannot invest directly in an index.

Although recently updated, it originally was authored in March 2020– before The Colony Group, LLC changed its name to Focus Partners. This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Wealth, LLC (“Focus Partners”), an SEC registered investment adviser with offices throughout the country. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of Focus Partners or its representatives. Prior to January 2025, Focus Partners was named The Colony Group, LLC. Focus Partners has been part of the Focus Financial Partners partnership since 2011.

©2025 Focus Partners Wealth, LLC. All rights reserved. RO-25-4802409

About the Author

Frank Brochin

Chief Investment Officer, Family Office