November 17, 2025

Monthly Investment Commentary: November 2025

Every market cycle eventually circles back to the same uncomfortable question: If valuations look stretched, how do they work their way down to more reasonable levels? There are only two paths. Either prices fall, or earnings rise faster than expected. Both get you there, but one feels much better than the other.

Right now, the evidence points to the more comfortable path as earnings continue to outperform expectations. With most of the S&P 500 having reported third-quarter results, 82% surprised to the upside, and the index is on track to grow earnings by 13.1%, well above the expectation of 7.9% before earnings season began. Profit margins remain healthy (and growing) at more than 13%. Investor optimism looks justified.

Are Valuations Still Too High?

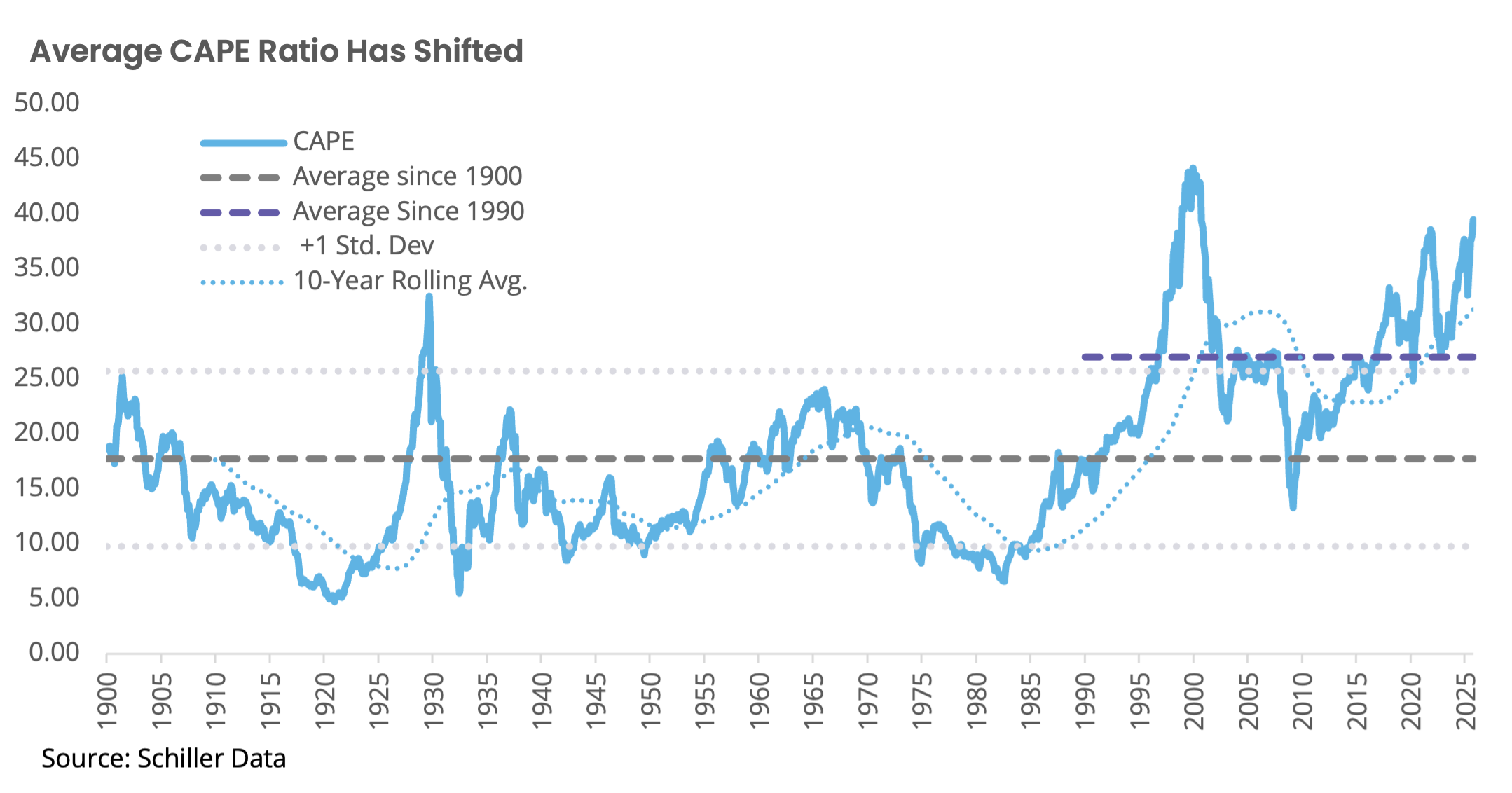

Valuations are high, but perhaps not as abnormal as investors fear. Market historians point to today’s cyclically adjusted price-to-earnings ratio (CAPE ratio—a measure of valuation that smooths out the temporary effects of economic cycles and short-term earnings volatility), which is at nearly 40x compared to a long-term average of about 18x since 1900.

However, looking at the data suggests that a change occurred at the end of the 1990s, which warrants attention. Over the last 35 years, the average CAPE ratio has increased to almost 26x, more than one standard deviation above its long-term average. So, what investors have considered average over the past 30 years would have felt astronomical to investors during almost any other period since 1900.

A significant shift occurred in the economic structure over the past three decades. Technology and profitability dynamics are the obvious culprits. Companies began generating more profits with fewer physical assets, boosting their margins, capital efficiency, and earnings. Markets rewarded that with higher valuation multiples.

Earnings Estimates Are More Challenging

Part of the challenge in valuing companies today also involves estimating future earnings growth. Analysts are clearly struggling to keep up, as even their estimates of current spending have proven to be overly conservative. That’s likely because artificial intelligence (AI) spending tends to be more “all or nothing” than the sales patterns of consumer goods. When the outcome is increasingly binary, there can be a wide gap between optimistic and pessimistic forecasts. As companies ramp up their adoption of and spending on AI faster than expected, estimates end up too low. If analysts can’t get the current quarter right, the long-term projections are nearly impossible to pin down.

Risks Remain

While stronger-than-expected earnings help ease valuation concerns, the AI buildout introduces new pressures. Part of what’s driven higher valuations over the last three decades has been the technology industry’s asset-light business models. As firms now spend more on computing power, a growing risk is that this could trickle through to margins. So far, that has not happened. With third-quarter earnings beating expectations, should investors be concerned about headlines warning that valuations are high? We take a closer look at whether valuations are stretched—and the ways they could adjust.

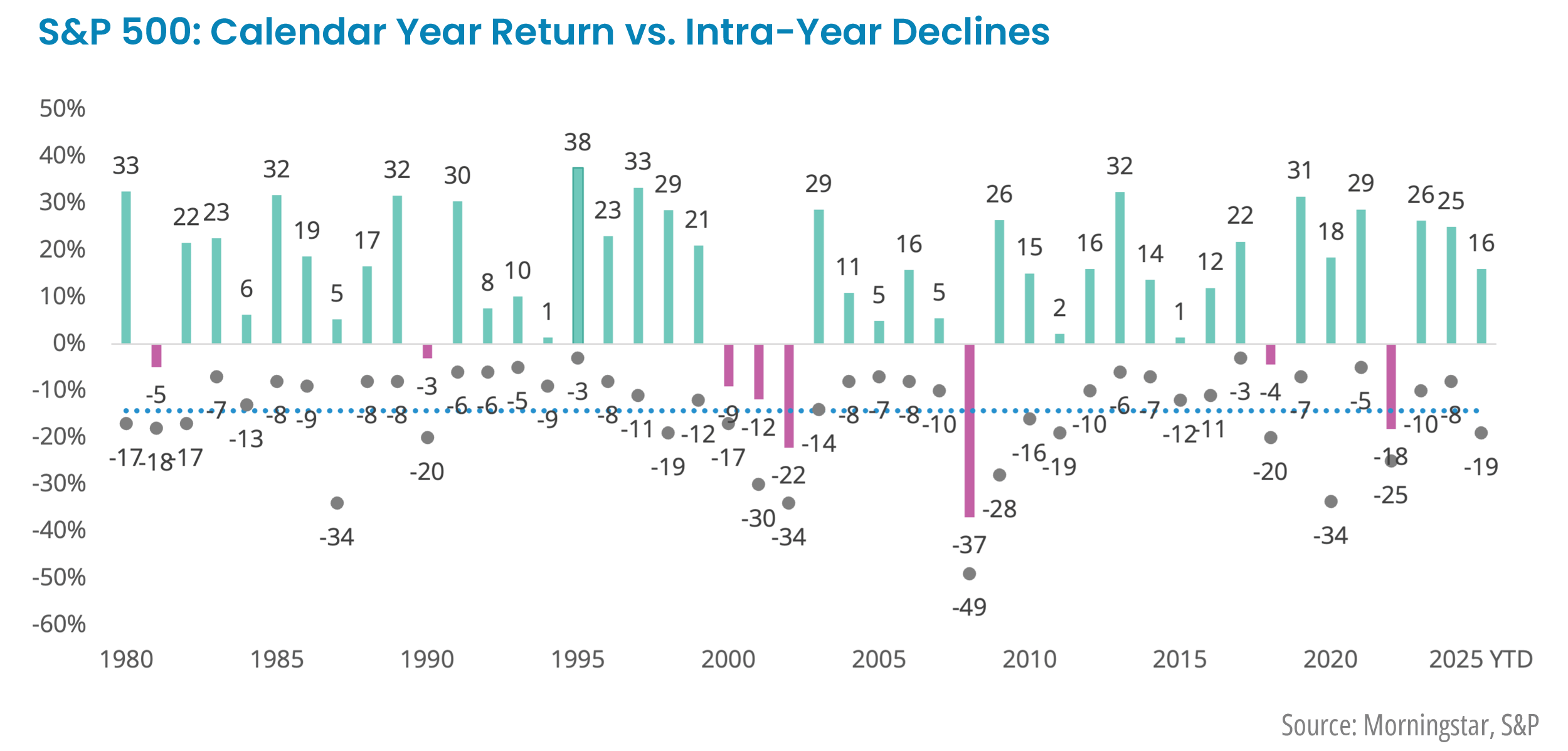

This does not mean that investors should not expect regular bouts of volatility. Throughout bull markets, high-profile prognosticators will commonly throw out the easiest of all market predictions: “The market will decline by 5%-15% over the next 1-2 years.” Why is this such an easy prediction? Because it’s almost always true. Since 1980, the market has experienced an average intra-year decline of about 14% each year, despite ending most years in positive territory.

Takeaway for Investors

The bottom line is that earnings growth continues to be the release valve for elevated valuations. Prices do not need to fall if profits continue to climb, and so far, companies are succeeding. Yes, risks remain, and investors should maintain a diversified portfolio for a wide range of outcomes, including both bear and bull cases. However, when fundamentals outpace expectations, it becomes more challenging to argue that valuations must snap back simply because they appear to be at uncomfortable levels.

Markets have a long history of rewarding genuine progress over tidy narratives. Currently, the progress is evident in the numbers. The narratives will catch up eventually.

Click here to download the November Monthly Investment Commentary.

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment, tax, or legal advice. Individuals should seek advice from their wealth advisor or other advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice.

This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication.

Services are offered through Focus Partners Advisor Solutions, LLC and Focus Partners Wealth, LLC (collectively referred to in this document as “Focus Partners”), SEC registered investment advisers. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of the RIAs or their representatives. ©2025 Focus Partners Wealth, LLC and Focus Partners Advisor Solutions, LLC. All rights reserved. RO-25-4980245

Category

InvestingContent Topics

About the Author

Jason Blackwell

Chief Investment Strategist