December 11, 2025

Monthly Investment Commentary: December 2025

Markets fared better than sentiment suggested this year, and 2026 could be even noisier. Yet strong earnings, tax benefits for consumers, and AI-related productivity gains could help position the economy for continued resilience.

As we enter the last month of the year, it is natural to reflect on 2025 and consider the trends that could shape 2026. This year has been excellent for investors around the globe. The S&P 500 looks set to post another double-digit return, international stocks are approaching a 30% gain, and even smaller stocks logged respectable, if lagging, performance. Fixed income joined the party as high-quality taxable bonds returned more than 7% through November.

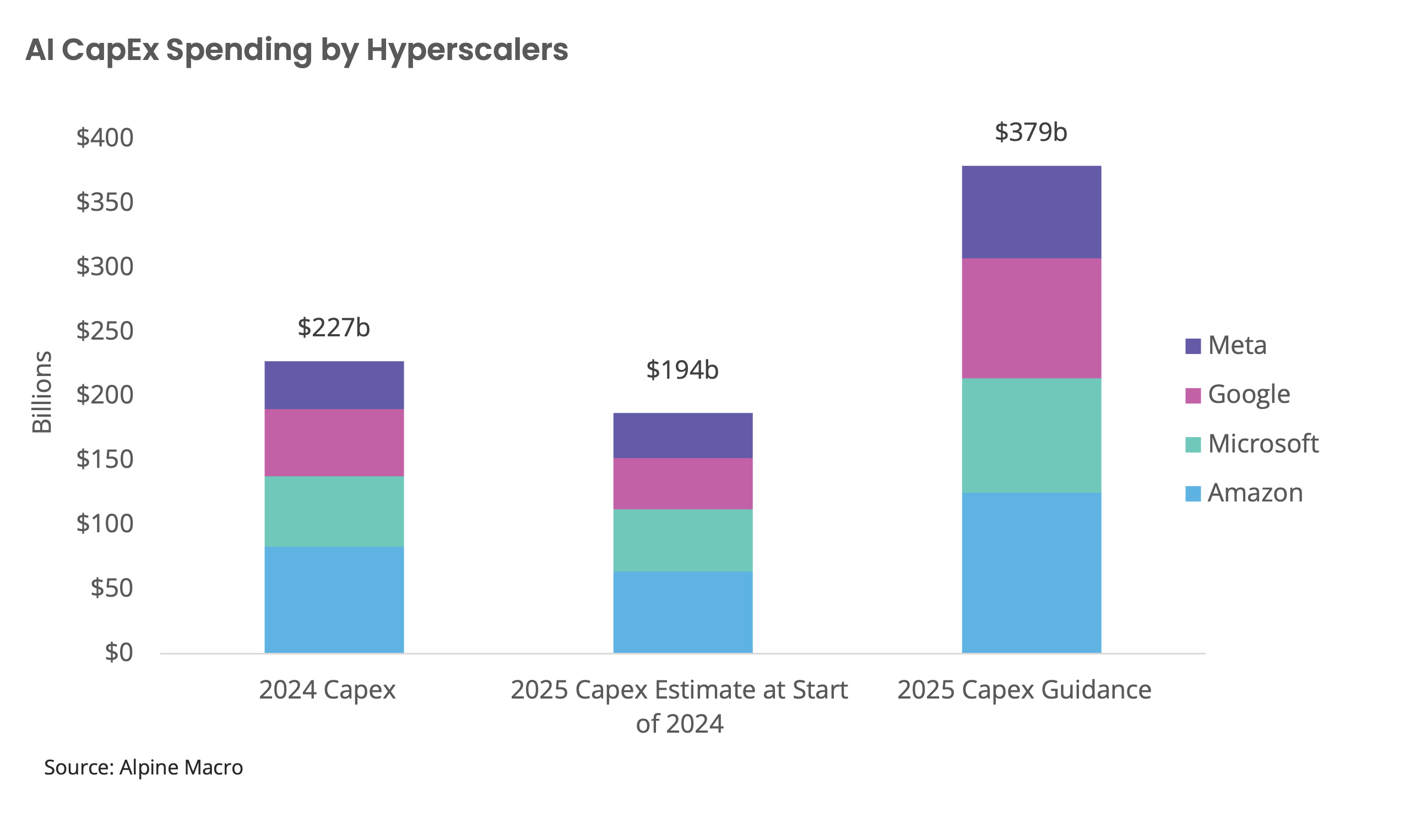

The first act of 2025 played out with far more drama than the final numbers suggest. A new administration arrived with tariffs and the DOGE program at the top of its agenda, overshadowing the administration’s efforts on tax cuts and deregulation. The unexpected policy announcements led the S&P 500 to approach bear market territory before going on to make new highs. It was a good reminder that markets usually digest political transitions reasonably well and shift their attention back to company performance. That happened again as Big Tech’s artificial intelligence (AI) spending, which could top $400 billion in 2026, quickly drowned out the political noise.

As we look ahead, there is no shortage of potential distractions that could create volatility in 2026.

Domestic Politics

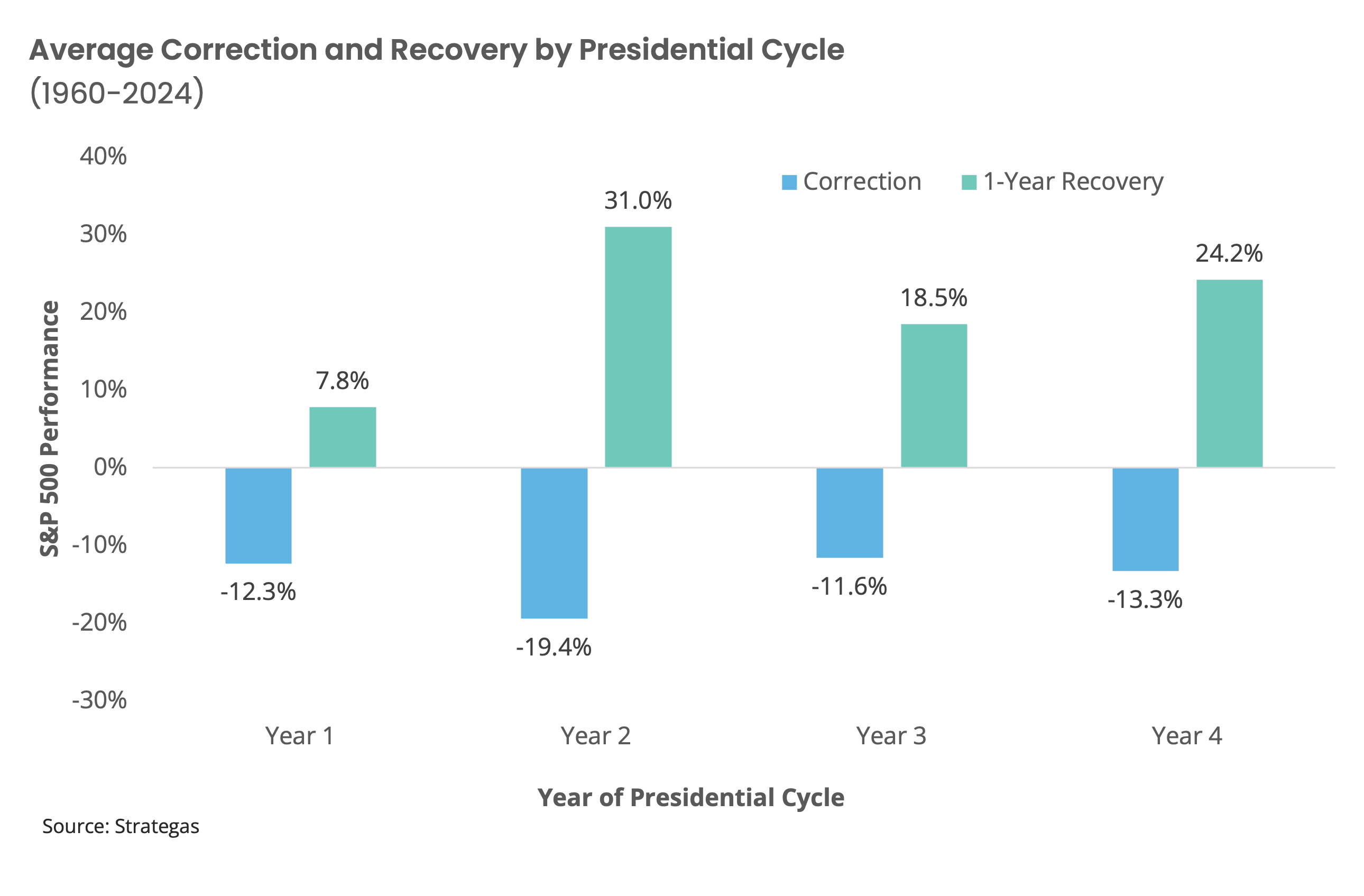

Midterm years are historically the weakest of a presidential cycle, and the second year of a term has typically delivered the deepest correction. Investors will have plenty to fret about including taxes, spending, trade policy, and AI regulation. Yet the historical pattern also shows that recoveries following these corrections are just as robust. Long-term investors who can see through the political fog have usually been well rewarded.

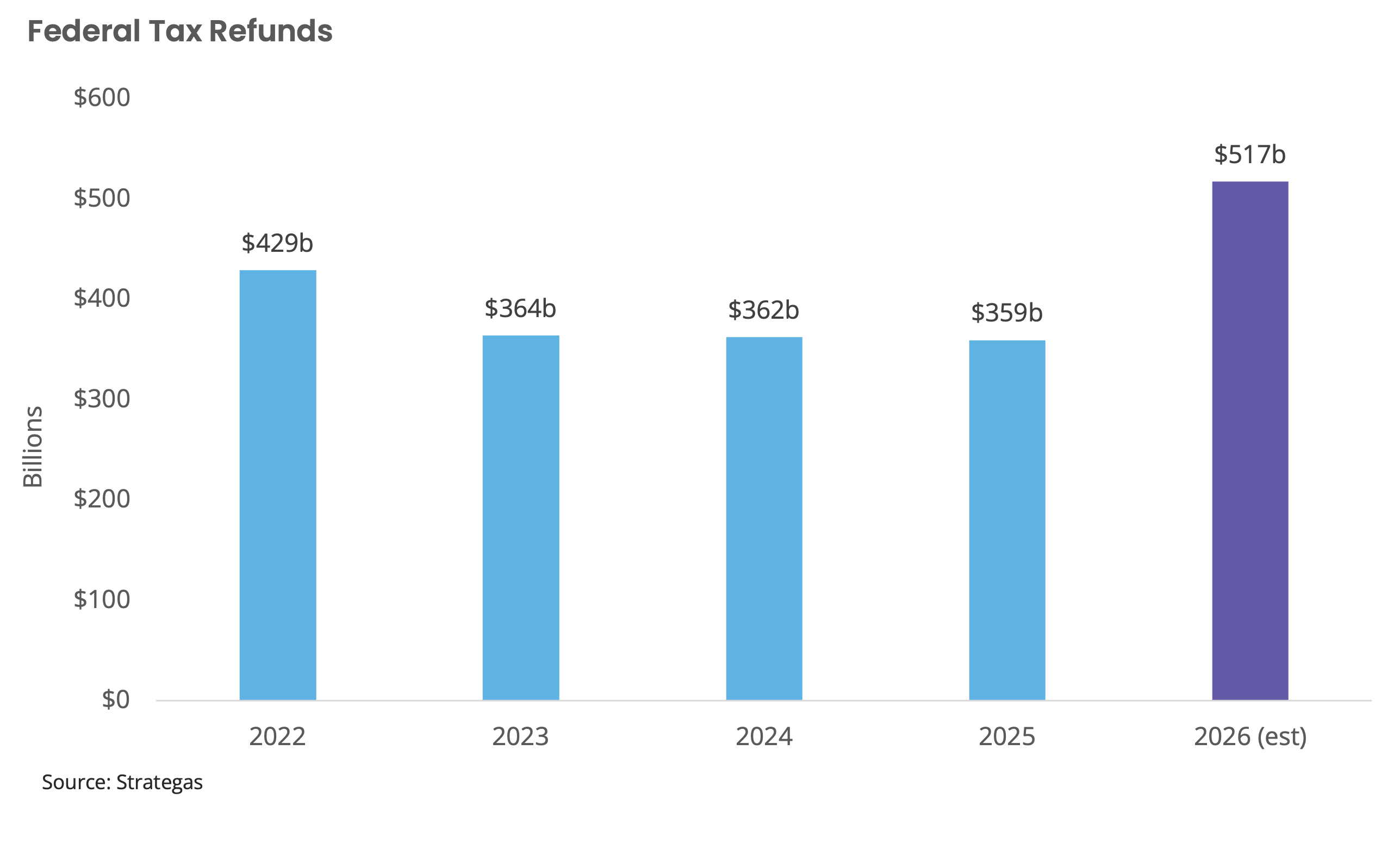

A potential bright spot for markets is that consumers may experience a near-term sugar rush. The tax benefits of the One Big Beautiful Bill Act should hit bank accounts during the 2025 tax filing season, with estimates suggesting more than $517 billion in refunds. That is a 44% increase over 2025 and could give consumption a timely boost in the first quarter.

Federal Reserve Policy

With inflation above the Federal Reserve’s target and growth slowing, the central bank faces a delicate balancing act: supporting a cooling job market without reigniting price pressures. The Federal Open Market Committee has become more fractured as dissenters push for tighter and looser policy. It is not a great sign when the committee charged with steering the economy cannot agree on which direction the wheel should turn.

On top of that, 2026 could bring the biggest reshaping of the Fed since the financial crisis. With Chair Jerome Powell’s term ending in May and uncertainty surrounding Governor Lisa Cook’s position, five of the seven board seats could become Trump appointees. Five reserve bank presidents are also up for reappointment. The result could be a central bank with a very different philosophical makeup at a time when policy is already at a crossroads.

Federal Reserve Voting Members in 2026

14-Year Term Ends: | ||

Board Of Governors | Stephen Miran (President Trump appointee) | 1/31/2026 and 2040 |

Jerome H. Powell, Chair through May (Presidents Obama, Trump, and Biden appointee) | 1/31/2028 | |

Christopher J. Waller (President Trump appointee) | 1/31/2030 | |

Michael S. Barr (President Biden appointee) | 1/31/2032 | |

Michelle W. Bowman (President Trump appointee) | 1/31/2034 | |

Philip N. Jefferson (President Biden appointee) | 1/31/2036 | |

Lisa D. Cook (President Trump announced firing) | 1/31/2038 | |

Reappointment & | ||

Reserve Bank Presidents | New York - John C. Williams | Feb 2026 & June 2028 |

Philadelphia - Anna Paulson | Feb 2026 & July 2035 | |

Cleveland - Beth M. Hammack | Feb 2026 & Jan 2037 | |

Dallas - Lorie K. Logan | Feb 2026 & Feb 2038 | |

Minneapolis - Neel Kashkari | Feb 2026 & July 2038 |

Credit Cracks

Private credit has enjoyed a golden era as borrowers sought speed and certainty while investors chased higher, floating-rate yields. The market has grown rapidly as a result, but the tone is beginning to shift. The Fed has flagged the asset class as a vulnerability, but it has also noted that the diversity of lenders reduces the systemic risk compared to the old bank-dominated model.

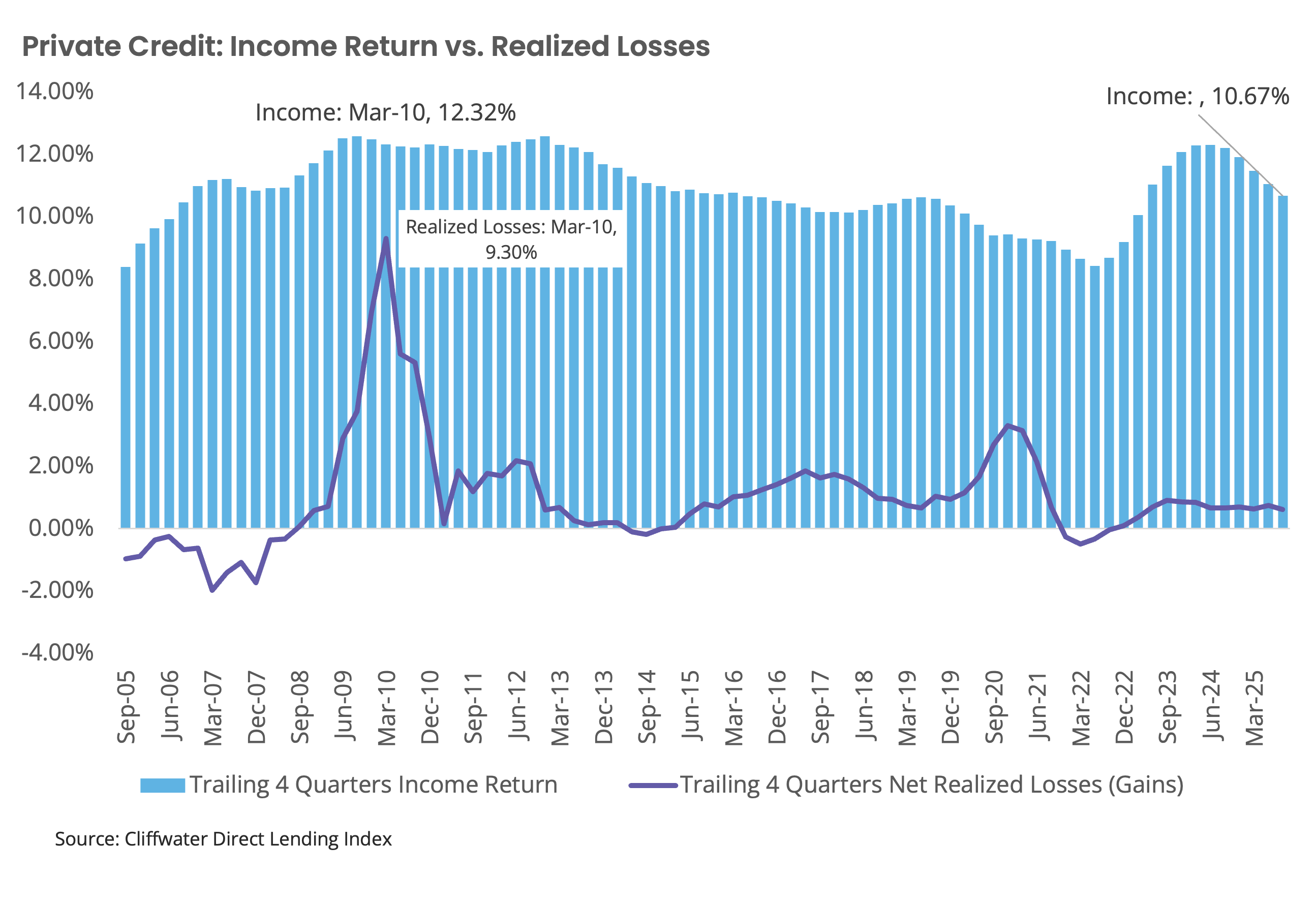

Recent headlines about private credit have made some investors understandably skittish about the potential for outsized losses. It helps to remember that private credit is primarily an income-driven strategy rather than a price appreciation strategy. Historically, that income has been the main driver of total returns.

Even in the worst 12-month stretch of the financial crisis, realized losses reached 9.3% while income was 12.3%, leaving a positive spread of just over 3%. In other words, losses would need to climb well above crisis-era levels before income would fail to offset them.

At the same time, the ecosystem looks different today. The market is much larger, underwriting can vary across managers, and fair value marks can create more visible mark-to-market swings. That combination does not necessarily imply worse long-term outcomes, but it does raise the potential for greater volatility, making manager selection and diversification even more important.

AI Becomes a Show Me Story

Perhaps the most important risk and opportunity for markets in 2026 is the evolution of AI from a capital expenditure story to a results story. It has been easy to generate excitement over proofs of concept and impressive demos. Next year may be the moment when investors demand more than promise. The question will shift from what AI might do to its realized impact.

That requires moving beyond chatbots and meme generation into tangible product innovations and measurable financial outcomes. Will 2026 be the year we see the first widely available full self-driving system? Will non-tech companies show they can grow revenue with the same or fewer employees? Can AI deliver margin expansion in sectors that have seen little innovation for decades?

The risk is two-sided. We have little doubt AI will deliver over time, but if product cycles or adoption rates disappoint, markets could struggle with impatience. Conversely, if the cycle exceeds expectations, the upside could be tremendous. General purpose technologies tend to follow the classic pattern of overestimating short-term impact and underestimating long-term transformation. AI looks increasingly like one of those technologies.

Looking Ahead

Overall, market performance this year was better than it felt at times, and 2026 will likely be noisier than many would prefer. Politics, the Fed, and private credit markets are likely to generate headlines with the potential to stir markets. But earnings remain solid, consumer support is set to strengthen early in the year, and AI-driven productivity gains could lead to developments far more important than in a typical market cycle.

The key for investors is to separate signal from noise. Markets can be easily entertained by the headlines, but they ultimately care about the fundamentals. There is no reason to expect 2026 to be any different.

Click here to download the December Monthly Investment Commentary.

The information provided is educational and general in nature and is not intended to be, nor should it be construed as, specific investment, tax, or legal advice. This reflects the opinions of Focus Partners or its representatives, may contain forward-looking statements, and presents information that may change. Nothing contained in this communication may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance does not guarantee future results. Market conditions can vary widely over time, and certain market and economic events having a positive impact on performance may not repeat themselves. The charts and accompanying analysis are provided for illustrative purposes only. Investing involves risk, including, but not limited to, loss of principal. Focus Partners' opinions may change over time due to market conditions and other factors. Numerous representatives of Focus Partners may provide investment philosophies, strategies, or market opinions that vary. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Any index or benchmark shown or discussed is for comparative purposes to establish market conditions. Index returns are unmanaged and do not reflect the deduction of any fees or expenses and assumes the reinvestment of dividends and other income. You cannot invest directly in an index.

This is prepared using third party sources considered to be reliable; however, accuracy or completeness cannot be guaranteed. The information provided will not be updated any time after the date of publication. Please be advised that Focus Partners only shares video and content through our website or other official sources.

Services are offered through Focus Partners Advisor Solutions, LLC and Focus Partners Wealth, LLC (collectively referred to in this document as “Focus Partners”), SEC registered investment advisers. Registration with the SEC does not imply a certain level of skill or training and does not imply that the SEC has endorsed or approved the qualifications of the RIAs or their representatives. Prior to January 2025, Focus Partners Advisor Solutions was named Buckingham Strategic Partners, LLC, and Focus Partners Wealth was named The Colony Group, LLC.

©2025 Focus Partners Wealth, LLC and Focus Partners Advisor Solutions, LLC. All rights reserved. RO-25-5041564

Category

InvestingContent Topics

About the Author

Jason Blackwell

Chief Investment Strategist